Reporting Tips

- *New* How to Craft a Technical Competency Response Video

- *New* How to Craft an Enabling Competency Response Video

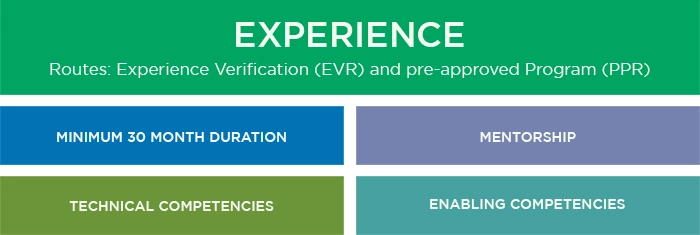

- Pre-Assessment Checklist for Experience Verification Route (EVR) Candidates

(updated as of April 17, 2023) - CPABC's Technical Competency Guiding Questions

(updated as of October 12, 2023) - Enabling Competencies - Checklist

(updated as of April 17, 2023) - Change of Job: EVR to EVR

(updated as of March 1, 2022) - Change of Job: EVR to PPR

(updated as of March 1, 2022) - Change of Job: PPR to EVR

(updated as of March 1, 2022) - Change of Job: PPR to PPR

(updated as of March 1, 2022)