CPD Requirements

Basic Requirements

Every member must comply with the minimum basic requirements of CPABC’s Continuing Professional Development Program prescribed under Bylaw Regulation 600/2, unless exempted.

Professional competence

Rule 203 of the CPABC Code of Professional Conduct may require a member to complete more than the prescribed minimum number of CPD hours to maintain the level of professional competence necessary for the work in which they are engaged.

Rule 203 (Professional competence) states:

“A member shall sustain professional competence by keeping informed of, and complying with, developments in professional standards in all functions in which the member provides professional services or is relied upon because of the member’s calling.”

Reporting Requirements

Members of CPABC are required to report compliance with the CPD requirements by filing an annual CPD report by January 31 for the previous calendar year.

Important Dates |

|

| Completion of CPD Required for the Year | December 31 |

| CPD Reporting Deadline | January 31 |

| AML PD Compliance Deadline | December 31, 2026 |

What Qualifies as CPD?

CPD is learning that is relevant and appropriate to a member’s work/professional responsibilities and growth as a CPA. CPD does not have to be taken through CPABC – it does not even have to be taken in Canada. CPD may be completed through any learning institution, organization, employer, or even online. CPD does not necessarily have to be accounting related – it just has to be relevant to the member’s particular employment or professional role, business situation, or career aspirations.

Prescribed Minimum CPD Requirements

| Prescribed Minimum CPD Requirements (in hours) |

Verifiable CPD | Additional CPD * | Total CPD |

|---|---|---|---|

|

Annual |

10 |

10 |

20 |

|

Rolling three-calendar-year period |

60 |

60 |

120 |

* Additional hours can be fulfilled with verifiable and/or unverifiable CPD

** AML PD may also be reported as part of your verifiable professional ethics CPD hours

Verifiable vs. Unverifiable CPD

Verifiable Qualifying Hours

Refers to learning activities for which there is satisfactory evidence to objectively verify participation. Members may only report the actual number of hours that were spent developing new or existing competencies.

Examples of verifiable CPD:

- Attendance, as a participant or lecturer, at courses, conferences, seminars, workshops, presentations, technical committees or discussion groups;

- Research that results in publications or presentations;

- Structured employer-based in-house training sessions;

- Programs of study that involve the successful completion of an examination or certification;

- Computer-based learning activities that involve the successful completion of an examination or certification; and

- Professional re-examination or formal testing.

Unverifiable Hours

Unverifiable hours include learning activities relevant to the member’s professional role that cannot be verified objectively, such as:

- On-the-job learning;

- Self-study that does not involve the successful completion of an examination or certification, including the use of computer-based learning activities, conference reference materials or webinars;

- Self-study that involves the completion of an examination, for which the examination is not in the current CPD reporting year; and

- Casual reading of professional journals or magazines.

Professional Ethics Hours

Members must complete a minimum of four verifiable professional ethics hours in each rolling-three-calendar-year period.

Just like other verifiable learning activities, the professional ethics requirement can be fulfilled through CPABC or other sources. The four hours can be accumulated through various separate professional ethics learning activities over the three years. Professional ethics learning activities must go beyond an awareness of the law, standards or guidelines. The learning activity must address the application of ethical principles or theories to the laws, standards or guidelines relevant to the member’s work and professional responsibilities. For additional information, please refer to our website.

Anti-Money Laundering (AML PD)

CPABC has introduced a mandatory requirement to take AML PD. This was deemed necessary in order to:

- raise and enhance membership awareness regarding money laundering and its risks;

- assist the profession in detecting, preventing, and combatting money laundering; and

- understanding the related obligations for CPAs under the federal anti-money laundering regime.

AML PD refers to verifiable qualifying learning activities related to anti-money laundering. Starting in 2024, members must report 1.5 verifiable hours of AML PD by December 31, 2026 – this is a one-time requirement. AML PD activities must be submitted through the AML PD reporting portal, available in the CPD Reporting section of services.bccpa.ca (Look for “AML PD Requirement – Submit Declaration” in the right-hand menu.)

Learning activities reported for the AML PD declaration may also be reported as verifiable ethics CPD on your annual CPD report.

CPABC PD offers several free courses that satisfy the AML PD requirement or members can report AML PD courses offered by CPA Canada, their employer, or a third-party PD provider. Further, the 1.5 hours required can be accumulated through multiple separate AML PD learning activities over the three years.

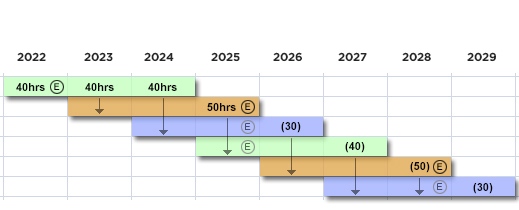

Example: Rolling Three-Calendar-Year Period

The example provided references total CPD hours but can also be applied to verifiable CPD hours.

E – denotes verifiable professional ethics

- 2022-2024: In the first rolling three-year period, the member completes 40 hours of CPD each year. The member completes four verifiable hours of professional ethics in 2022.

- 2025: the member completes 50 hours of CPD, for a total of 130 CPD hours for the 2023-2025 rolling three-year period.

- 2026: to meet the requisite 120 hours for the 2024-2026 rolling three-year period, the member needs to complete a minimum of 30 hours of CPD. Assume that the member only completes the minimum 30 hours of CPD in 2026

- 2027: to meet the requisite 120 hours for the 2025-2027 rolling three-year period, the member needs to complete a minimum of 40 CPD hours.

- A member who met the verifiable professional ethics requirement in 2022 and did not complete any professional ethics CPD in 2023 or 2024 would need to meet the requirement again in 2025, and so on. Four hours of professional ethics is required every rolling three-year period.

CPD Exemptions

CPD Exemption from the Basic Requirements

Members who meet all of the following criteria may be exempt from the prescribed minimum number of CPD hours:

- Their Gross Active Revenues* does not exceed C$32,300 for the calendar year;

- They do not engage in public practice as defined in the CPABC Bylaws at any time in the calendar year;

- They do not serve in any of the following capacities for a public company or reporting issuer as defined in the CPABC Code of Professional Conduct at any time in the calendar year:

- As a member of its board or similar governing body; or

- As a member of its audit, finance, or similar governance committee; and

- They comply with “Rule 203 (Professional competence)” in the CPABC Code of Professional Conduct.

*Gross Active Revenues include the aggregate of accounting and non-accounting revenues from employment, self-employment, and all other active sources, whether earned personally or through a business entity. Gross Active Revenues do not include Employment Insurance benefits, pension income, support payments, or disability income.

To declare eligibility for exemption from the prescribed minimum number of CPD hours, please sign into CPABC’s secure website.

Learning Plan

Members who no longer qualify for exemption after having been exempt for three or more consecutive CPD years are strongly encouraged to create a CPD learning plan to ensure that they develop the competencies necessary for their roles. We recommend that members contact CPABC’s professional advisory team at professionaladvisory@bccpa.ca for guidance on developing an effective learning plan. You can also refer to this article Effective Learning Plans to help you in developing your learning plan.

CPD Exemption from Annual Reporting

Members who meet the eligibility requirements for the CPD exemption from the Basic Requirements and who have no intention of performing activities that would cause them to lose eligibility may also make a declaration for exemption from annual reporting.

To declare eligibility for exemption from annual reporting, sign into CPABC’s secure online services area.

Non-Residents of BC

Non-resident members of CPABC who meet and report their CPD activities to another provincial/territorial CPA body in Canada do not need to duplicate their detailed CPD reporting. The same applies to members who reside outside of Canada and meet and report their CPD activities to an international accounting body whose requirements are compliant with the International Federation of Accountants’ International Education Standard where they are also a member. Such members only need to indicate the jurisdiction in which their membership is held on the annual CPD exemption declaration. All other non-resident members must report their CPD, specifying verifiable and unverifiable CPD hours.

Note: All CPABC members regardless of residency must comply with the AML PD requirement.

Extenuating Circumstances

Members who have a valid reason for an exemption from the prescribed minimum number of CPD hours may submit a written request to the Membership Committee to consider their circumstances using CPABC’s secure website. Members who submit a request related to a medical condition must attach CPABC’s Medical Form completed by their medical practitioner. Please note that members are expected to plan and allocate time to CPD; being “too busy” is not a valid reason for exemption from CPD. The Committee will review each request on a confidential basis. Based on the information submitted, a determination will be made and forwarded to the member.

CPD Verification

Each year, CPABC verifies a sample of CPD reports and declarations for CPD exemption for the preceding three-calendar-year period.

Retention of Documentation

Members are required to retain documentation supporting their CPD activities for at least five years after the end of the reporting period. Please ensure you have access to your supporting documentation, if you change employers.

There is no need to submit the supporting records unless requested.

Verifiable CPD documentation should:

- Describe the learning activity;

- Identify the provider of the activity, where applicable;

- Connect the member to the activity;

- Identify when the activity took place; and

- Provide a basis for concluding that the number of reported hours is reasonable.

Examples of documentation:

- Certificate of completion or official transcript

- Confirmation of participation by provider or employer (e.g. registration confirmation)

- Attendance record (e.g. sign-in sheet)

- Course assignment and exam results

- Copy of course outline/agenda

- Copy of course payment/invoice

Members who have declared eligibility for a CPD exemption may be requested to provide proof of eligibility for the CPD exemption. This may include proof of Gross Active Revenues. Failure to provide satisfactory proof when requested may result in a revocation of the CPD exemption and/or a referral to the Investigation Committee.

Additional CPD Information

New Members Admitted to CPABC Membership

New members admitted to membership are required to report CPD in the calendar year of admission. The CPD reporting year is the calendar year. There is no proration of the CPD requirements in the year of admission. CPD completed anytime in the calendar year will be eligible for CPD credit. The first rolling three-calendar-year period begins in the year of admission.

Anti-Money Laundering (AML) PD Requirement

CPABC has introduced a mandatory requirement to take AML PD. This was deemed necessary in order to:

- raise and enhance membership awareness regarding money laundering and its risks;

- assist the profession in detecting, preventing, and combatting money laundering; and

- understanding the related obligations for CPAs under the federal anti-money laundering regime.

Effective January 1, 2024, the new Bylaw Regulation, requires all new members to take 1.5 AML hours by the end of the second calendar year following the calendar year of their initial admission as a member. Members are able to take any AML courses, including those offered by other PD providers or internally through your place of employment. CPABC offers a number of AML PD courses, for additional information, please visit our CPABC PD Website.

Transitional Provision for Student PD Requirements (CFE graduates)

Beginning 2019, Effective Management Skills and the seven-hour soft skills course are no longer required to be completed prior to admission to membership. As a transitional provision, students who have completed these courses prior to the year of admission may carryover these courses into their first CPD reporting year. Except for this transitional provision, there is no carryover of CPD from one calendar year to a subsequent year.

The seven-hour introductory course on the privileges, obligations and ethics of the profession (i.e. Gateway to Membership: Welcome to the Pros, or formerly, You and Your Designation) is still required to be completed prior to admission to membership. As there is no change to this course requirement, there is no carryover of Gateway to Membership: Welcome to the Pros or You and Your Designation for CPD credit to a subsequent year.

The Gateway to Membership course will qualify as verifiable CPD hours for those candidates who take the course in the same calendar year that they are admitted to membership. The Gateway to Membership course is eligible for 7 verifiable hours (of which 4 hours are professional ethics). If the course is taken outside of the calendar year of admission to membership, it will not qualify for CPD credit.

Competency Declaration for Audit Licensees

Practitioners seeking or renewing an Audit License are required to complete an annual self-assessment and declaration that they have undertaken sufficient relevant CPD to develop and maintain professional competence for their role. This new requirement is the result of revisions to International Education Standard 8 (Revised) and CPABC’s adoption of the standard in accordance with our commitment to meeting international standards.

The objective of IES 8 (Revised) is to protect the public, contribute to audit quality, enhance the work of Engagement Partners, and promote the credibility of the audit profession. IES 8 (Revised) requires “professional accountants performing the role of an Engagement Partner to develop and maintain professional competence that is demonstrated by the achievement of learning outcomes. For a list of the learning outcomes and additional information on this new requirement, please visit our Competency Declaration for Audit Licensees webpage.

Competency Declaration for Audit Licensees

Practitioners seeking or renewing an Audit License are required to complete an annual self-assessment and declaration that they have undertaken sufficient relevant CPD to develop and maintain professional competence for their role. This new requirement is the result of revisions to International Education Standard 8 (Revised) and CPABC’s adoption of the standard in accordance with our commitment to meeting international standards.

The objective of IES 8 (Revised) is to protect the public, contribute to audit quality, enhance the work of Engagement Partners, and promote the credibility of the audit profession. IES 8 (Revised) requires “professional accountants performing the role of an Engagement Partner to develop and maintain professional competence that is demonstrated by the achievement of learning outcomes. For a list of the learning outcomes and additional information on this new requirement, please visit our Competency Declaration for Audit Licensees webpage.

Contact Information

Jacqueline Chow

Membership and CPD Coordinator

cpd@bccpa.ca

604 637.8388

Or

Lisa Murray

Manager, Membership Administration

cpd@bccpa.ca

604 488.2614