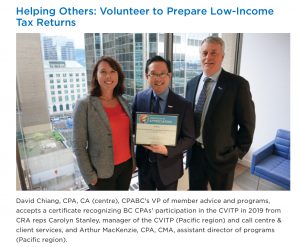

Recap: Community Volunteer Income Tax Program Info Session Community

CPABC recently hosted two outreach events for members interested in volunteering their services. The first was held in Vancouver on January 23, 2020 followed by another in Victoria on January 27, 2020. Over 110 members attended these sessions to hear CRA representatives (Karen Martin and Karen Brar) explain how members can get involved in the Community Volunteer Income Tax Preparation program as well as from CPAs who have previously volunteered. At the Victoria session, CPABC member Wade Fallan CPA CGA, shared his experience volunteering at tax clinics in remote communities. Wade was profiled in the January/February 2020 In Focus magazine.

Are you willing to lend a hand to help seniors, newcomers to Canada, and low-income Canadians qualify for various tax credits available? Then, consider getting involved with the CRA’s CVITP program. Last year, 295 CPABC members volunteered and completed almost 13,000 tax returns.

To get involved as a volunteer at a local tax clinic you can register under the CVITP program at www.canada.ca/guide-taxes-volunteer.

Note that the preparation of tax returns is a regulated activity which would normally require licencing. However, an exemption from licensing is available to support this important community service. CPABC members who are not already licensed for public practice must apply for this exemption through Online Services located on the www.bccpa.bc homepage. Members who apply for this exemption are covered under CPABC’s blanket professional liability insurance provided that the voluntary tax services are performed in BC and are basic tax returns that meet CRA’s income threshold to be considered low income returns.