Practice Review Program Overview

The purpose of the Practice Review Program (PRP) is to protect the public through assessing a practitioner’s/firm’s compliance with professional standards, and by proposing appropriate follow-up or remedial action in instances of non-compliance. In addition, the PRP protects the public by providing an educational experience to practitioners and firms. Practice reviews are performed on a risk-adjusted cycle, which typically occur once every three years, and in the case of a newly registered firm, within its first year of operation.

During the practice reviews, Practice Review Officers (PROs) may identify reportable deficiencies related to material areas, assertions, and disclosures where accounting or assurance standards are not met. Based on the nature and significance of the reportable deficiencies identified, the PRO assesses an inspection as one of the following three categories:

- Meets Requirements: no further action is required but the firm is still expected to address the reportable deficiencies (if any), and the firm will be reviewed in the ordinary course of the next cycle;

- Meets Requirements with Action Plan: the firm is required to provide an action plan which includes detailing how the reportable deficiencies will be addressed and, if deemed satisfactory, the firm will then be reviewed in the ordinary course of the next cycle; and

- Does Not Meet Requirements: the firm will be required to have a follow-up review within one year at a cost to be borne by the firm, along with other potential consequences required by the Public Practice Committee (the “Committee”).

The PRO’s assessment of the firm and the related reportable deficiencies are consistency reviewed by an Associate Director prior to being submitted to the Committee for approval on an anonymous and redacted basis. The Committee comprises 20 CPA members and two public representatives who meet four times a year to discuss and approve various matters, including the practice review results of firms.

In determining the action to be taken following a practice review, particularly if the firm was assessed as not meeting requirements for a second consecutive time, the Committee’s considerations include, but are not limited to:

- the degree to which the requirements of the PRP have been met;

- the nature and severity of the identified deficiencies;

- the adequacy of the firm’s action plan and/or analysis for restatement and commitment towards rectification of issues identified;

- the cooperation of the practitioner/firm and commitment towards improving overall firm quality;

- public interest; and

- on a follow-up review, the results of the previous practice review of the practitioner/firm and the degree to which the practitioner/firm addressed deficiencies identified in the initial review.

Introduction

CPABC has introduced a hybrid review model. All non-assurance reviews, and all reviews where a practitioner operates a home-based practice, are typically performed as desk reviews (i.e., reviews conducted remotely by the PRO). All other reviews may be conducted as in-person or desk reviews, based on the arrangements made between the practitioner/firm and the PRO.

This article will focus on key practice review observations from the past inspection year (April 1, 2022 to March 31, 2023), including the most significant areas where firms failed to meet standards. Thereafter, the report will cover areas of focus for the 2023-2024 inspection year.

2022-2023 Inspection Highlights

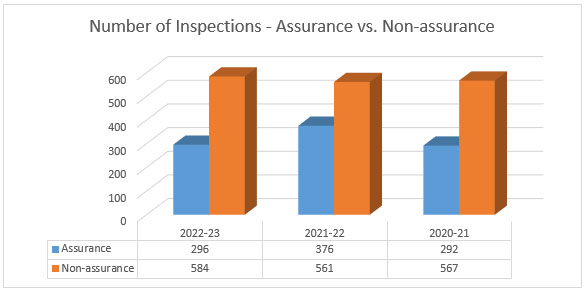

During the 2022-2023 inspection year, 880 (2021-22: 937) practice reviews were completed with an overall pass rate of 89% (2021-22: 94%). Of the total practice reviews completed:

- 296 (2021-22: 376) of the reviews, or 34% (2021-22: 40%), were practices that performed assurance engagements; and

- 584 (2021-22: 561), or 66% (2021-22: 60%), were practices that did not perform any assurance engagements (“non-assurance”).

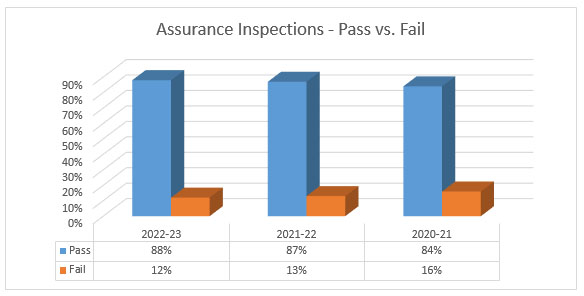

For the 296 reviews of practices which performed assurance engagements:

- 88% (2021-22: 87%) were assessed by the Public Practice Committee (the “Committee”) as “Meets Requirements” or “Meets Requirements with Action Plan”; and

- 12% (2021-22: 13%) were assessed by the Committee as “Does Not Meet Requirements” and, therefore, required a follow-up review of the practice, of which 2% (2021-22: 9%) were also required to have a supervised practice.

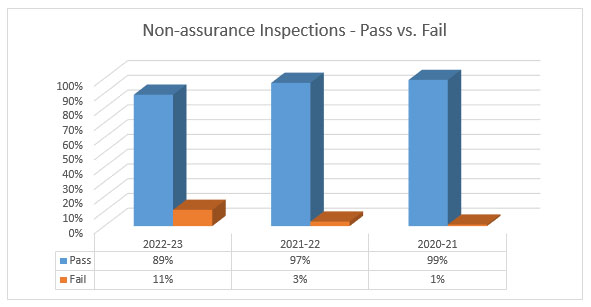

Of the 584 reviews of practices which did not perform any assurance engagements:

- 89% (2021-22: 97%) were assessed by the Committee as “Meets Requirements” or “Meets Requirements with Action Plan”; and

- 11% (2021-22: 3%) were assessed by the Committee as “Does Not Meet Requirements” and, therefore, required a follow-up review of the practice.

Lastly, included in the 880 practice reviews were 53 follow-up reviews of practices (i.e., firms that were assessed as “Does Not Meet Requirements” in their previous inspection). For these follow-up reviews:

- 91% (2021-22: 97%) were assessed by the Committee as “Meets Requirements” or “Meets Requirements with Action Plan”;

- 9% (2021-22: 3%) were assessed by the Committee as “Does Not Meet Requirements” and thereby, requiring another re-inspection of the office, of which 8% (2021-22: 0%) were also required to have a supervised practice.

For firms assessed as “Does Not Meet Requirements”, there were some notable findings:

- In a large number of these assurance reviews, there was inadequate work and/or insufficient documentation around key assertions of material balances and classes of transactions;

- For many non-assurance reviews, there was a failure to appropriately adopt CSRS 4200 Compilation engagements, such as missing the basis of accounting note and not including any documentation on understanding the entity and its processes.

- The occurrence of one (or more) material error(s) which was the result of not identifying or not applying the appropriate CPA Canada Handbook standard to an accounting or assurance issue; and

- Some firms continue to performed engagements outside of their core area of practice or in an area where they did not have substantial previous experience (“dabbling”). An example of this would be a practice that primarily performs review engagements and accepts an audit client, or a practice that focuses on not-for-profit audits and accepts an audit of a construction company.

Key Practice Review Observations

The items identified below may not be the most commonly identified deficiencies; however, they are considered some of the more significant items which can have a greater impact on the overall quality of work performed. The absence of sufficient evidence to support work performed in one or more of these areas could result in an inspection being assessed a “Does Not Meet Requirements” by the Committee.

Audit Engagements

- Documentation of risk assessment procedures with respect to obtaining an understanding of the entity and its environment, and the applicable financial reporting framework and the documentation of the entity's system of internal control did not include the entity's information system and communication relevant to the preparation of the financial statements. (CAS 315 paragraphs 19-27)

- When assessing the risk of material misstatement due to fraud, the auditor did not document management’s knowledge of actual, suspected or alleged fraud, or management’s process for identifying and responding to fraud and error. (CAS 240 paragraph 18-19)

- The auditor did not conduct a team planning meeting to discuss how and where the entity’s financial statements may be susceptible to material misstatement due to fraud, including how fraud might occur. (CAS 240 paragraphs 16, 45)

- The auditor did not perform analytical procedures to identify whether there were unusual or unexpected relationships in accounts that may indicates risk of material misstatements. (CAS 240 paragraph 23)

- The auditor did not document the design and performance of substantive audit procedures for each material class of transactions, account balances, and disclosures. (CAS 330 paragraph 18; CAS 500 paragraph 6)

- The auditor did not document the design and performance of audit procedures to test the appropriateness of journal entries recorded in the general ledger and other adjustments made in the preparation of the financial statements. (CAS 240 paragraph 33; CAS 330 paragraph 20)

- The written representation from management was not appropriately dated as near as practicable to the date of the auditor's report. Written representations are necessary audit evidence; as such, the auditor's opinion cannot be expressed, and the auditor's report cannot be dated, before the date of the written representations. Furthermore, because the auditor is concerned with events occurring up to the date of the auditor's report that may require adjustment to or disclosure in the financial statements, the written representations are dated as near as practicable, but not after, the date of the auditor's report on the financial statements. (CAS 580 paragraph 14)

- The auditor did not revise materiality when they became aware of information during the audit that impacted their initial determined amount. When a lower materiality was concluded than that initially determined amount, the auditor did not assess whether it was necessary to revise performance materiality and the appropriateness of the nature, timing, and extent of further audit procedures. (CAS 320 paragraphs 12-13)

- When the auditor identified misstatements, they did not evaluate whether the misstatements were indicative of fraud. When the auditor has reason to believe the misstatements may be the result of fraud that management is involved in, the auditor must reevaluate the assessment of the risk of material misstatement, and the impacts on the nature, timing and extent of audit procedures to respond to the assessed risks. (CAS 240 paragraphs 36-37)

- The auditor did not assemble the final audit file on a timely basis after the date of the auditor’s report. (CAS 240 paragraph 14)

Review Engagements

- The practitioner did not sufficiently document the inquiry and analytical procedures performed on the material items and/or areas in the financial statements where material misstatements are likely to arise. In obtaining sufficient appropriate evidence as the basis for a conclusion on the financial statements as a whole, the practitioner shall design and perform analytical procedures on material items in the financial statements and focus on addressing areas in the financial statements where material misstatements are likely to arise. The documentation shall be sufficient to enable an experienced practitioner, having no previous connection with the engagement, to understand the nature, timing, and extent of the procedures performed to comply with CSRE 2400 and applicable legal and regulatory requirements. (CSRE 2400 paragraphs 46, 104)

- The documentation of the practitioner's inquiries of management and others within the entity, as appropriate, did not include some or all of the inquiries required by paragraph 47. In a review, inquiry includes seeking information of management and other persons within the entity, as the practitioner considers appropriate in the engagement circumstances. The practitioner may also extend inquiries to obtain non-financial data if appropriate. Evaluating the responses provided by management is integral to the inquiry process. (CSRE 2400 paragraph 47)

- The documentation of the practitioner's understanding of the entity's accounting systems and accounting records was not completed or partially completed. The understanding establishes a frame of reference within which the practitioner plans and performs the review engagement and exercises professional judgment throughout the engagement. Specifically, the understanding needs to be sufficient for the practitioner to be able to identify areas in the financial statements where material misstatements are likely to arise, to inform the practitioner's approach to designing and performing procedures to address those areas. (CSRE 2400 paragraphs 43, 44)

- The practitioner did not obtain an understanding of the entity and its environment, and the applicable financial reporting framework, to identify areas in the financial statements where material misstatements are likely to arise and thereby provide a basis for designing procedures to address those areas. (CSRE 2400 paragraphs 43, 44)

- The date of the written representations was not as near as practicable to, or was after, the date of the practitioner's report. (CSRE 2400 paragraph 73)

- When performing an initial review engagement, the practitioner did not obtain sufficient appropriate evidence about whether the opening balances contain misstatements that materially affect the current period’s financial statements. (CSRE 2400 paragraph 55)

- When the prior period of the financial statements was subject to a review engagement or an audit engagement by a predecessor practitioner, the practitioner did not state this fact in an Other Matter paragraph. This alert should also include the date of the predecessor practitioner’s report, and the conclusion expressed by the predecessor practitioner, including the reason for modification if applicable. (CSRE 2400 paragraph 100)

- When the prior period of the financial statements was not subject to a review engagement or an audit engagement, the practitioner did not state this fact in an Other Matter paragraph in the practitioner’s report. (CSRE 2400 paragraph 101)

Financial Statement Presentation and Disclosure

- When the creditor has the unilateral right to demand immediate repayment of any portion or all of the debt under any provision of the debt agreement, the obligation was not classified as a current liability. (CPA Canada Handbook Part II – 1510 paragraph 13)

- Assets that were not ordinarily realized with one year from the balance sheet where incorrectly presented as a current asset. (CPA Canada Handbook Part II – 1510 paragraph 3)

- When an enterprise has multiple types of material revenue transactions, there was no disclosure of the different policies for each type. (CPA Canada Handbook Part II – 3400 paragraph 31)

- Government assistance received in the form of a forgivable loan was not accounted for in the same manner as a grant. (CPA Canada Handbook Part II – 3800 paragraphs 24, 25)

- When an enterprise has transactions with related parties the disclosure regarding these transactions was missing or missing required elements, such as: a description of the relationship, the measurement basis used, and the terms and conditions for amounts due to or from. (CPA Canada Handbook Part II – 3840 paragraph 51)

- Retractable or mandatorily redeemable shares issued in a tax planning arrangement were incorrectly presented as equity when either control was not retained by the shareholder receiving shares in the arrangement, or consideration was received by the enterprises when issuing the shares, or the holder of the shares has the contractual right to require the enterprise to redeem the shares on a fixed or determinable date or within a fixed or determinable period. (CPA Canada Handbook Part II – 3856 paragraph 23)

- When a financial liability was secured, the related disclosures were missing the carrying amount of the financial liability, the carrying amount of assets it has pledged as collateral, and the terms and conditions relating to its pledge. (CPA Canada Handbook Part II – 3856 paragraph 44)

- When a financial liability was in default or breach of any term or covenant that permits a lender to demand accelerated repayment during the period, there was no disclosure of this fact in the financial statements. (CPA Canada Handbook Part II – 3856 paragraph 46)

- When an organization receives or is entitled to receive restricted contributions, there was no disclosure on the policy it follows for accounting for those restricted contributions. (CPA Canada Handbook Part III – 4410 paragraph 21)

- When restricted contributions have been received and the organization follows the deferral method (or has received a restricted contribution in the general fund under the restricted fund method), it was not recorded correctly based on the restriction. (CPA Canada Handbook Part III – 4410 paragraphs 31, 33, 34, 38, 39, 40, 45)

- The entity incorrectly recorded an economic benefit as an asset on their balance sheet when the entity did not have the ability to control access to the benefit. (CPA Canada Handbook Part III – 1001 paragraph 25)

Compilation Engagements (CSRS 4200) and Tax Engagements

The Canadian Standard on Related Services (CSRS 4200) came into effect for compiled information for periods ending on or after December 14, 2021. As such, the majority of compilation files inspected relate to periods covered by CSRS 4200, instead of Section 9200. As many are aware, the new compilation standard represents a significant departure from Section 9200. Practitioners should ensure that they have reviewed the CSRS 4200 standard in the Handbook, attend a CSRS 4200 professional development course, and refer to CPA Canada’s CSRS 4200 resource page for further guidance.

Practitioners/firms that perform non-assurance work have continued to be fairly successful in meeting the requirements of the PRP (as indicated in the Practice Review Highlights section). Firms often included working papers in their file documentation to support the financial information as not being false or misleading. However, there were instances where working papers contained conflicting information which was not addressed or resolved, which led to requirements not being met. In addition, when firms had no underlying documents in their file to support the financial information, firms were determined to not meet the requirements of the PRP.

The following areas resulted in practitioners/firms not meeting the requirements of the practice review:

- Not adopting CSRS 4200 - some firms inappropriately attached a S9200 Notice to Reader report to the financial information prepared for a period ending on or after December 14, 2021. CSRS 4200 is required to be followed for all compilation engagements with periods ending on or after December 14, 2021.

- Not adequately adopting CSRS 4200 - some firms did not sufficiently adopt the new standard into their working papers. The documentation in the working paper files must meet the requirements as set out in CSRS 4200. This includes documentation regarding independence, client acceptance, knowledge of the business and an acknowledgement from management.

- Omitting a basis of accounting note - the basis of accounting note is a core element of the new standard. The purpose of the basis of accounting note is to help the users of the financial information understand how the financial information was prepared, and must be included.

- Inaccurate or misleading basis of accounting note - having an inaccurate or misleading basis of accounting note. For example, stating in the basis of accounting note that financial information is prepared in accordance with ASPE when there is no statement of cash flow, nor any of the required disclosures under ASPE, would be inaccurate and misleading.

With respect to tax engagements, specifically T1s and T2s, issues encountered were due to a lack of knowledge or compliance procedures, such as adherence to client filing deadlines and not obtaining signed and dated T183s from clients prior to e-filing returns.

Deficiencies related to a lack of documentation or incorrect tax treatment may result in a practitioner/firm not meeting the requirements of practice review. An example would be if a significant deduction was taken for a non-deductible amount, such as not adding back non-deductible life insurance or capital expenses in the calculation of net income for tax purposes. Pursuant to paragraph 18(1)(a) of the Income Tax Act, no deduction shall be made in respect of an outlay or expense except to the extent that it was made or incurred for the purposes of gaining or producing income from the business or property. In addition, pursuant to paragraph 18(1)(b) of the Income Tax Act, no deduction shall be made in respect of an outlay, loss or payment on account of capital, except as expressly permitted under the Income Tax Act.

The use of disclaimers has changed with the implementation of CSRS 4200. Prior to the effective date of CSRS 4200 (periods ending prior to December 14, 2021), practitioners included a disclaimer on financial information contained within tax returns (i.e., GIFI or T2125 – Statement of Business or Professional Activities or T776 – Statement of Real Estate Rentals) indicating that the information was “prepared solely for income tax purposes without audit or review from information provided by the taxpayer” as outlined in Section 9200. However, subsequent to the effective date of CSRS 4200 (periods ending on or after December 14, 2021), disclaimers should no longer be used on financial information contained within the tax returns. If a communication is to be attached to financial information, the only appropriate form of communication that can be attached is a compilation engagement report under CSRS 4200, which would also require the practitioner to meet all the documentation requirements of CSRS 4200.

Additional common deficiencies noted in compilation and tax engagements are as follows:

- Lack of documentation for an accountant’s consideration and assessment of independence, for example, when bookkeeping services were provided.

- No documentation within the file regarding consideration of foreign income and assets.

Quality Control

Some practitioners have not performed ongoing evaluation of their quality control system, nor have they completed their cyclical monitoring. Engagement monitoring activities have a positive impact on engagement quality and are expected to be performed.

CSQM 1 and CSQM 2 replaced CSQC 1 as of December 15, 2022 for assurance engagements. In a number of the practice reviews performed since the effective date of the new standard, it was noted that the system of quality management was not updated to be in line with the new standard.

See additional discussion below over CSQM 1 and CSQM 2.

Focus Areas for the 2023-2024 Practice Inspection Year

Quality Monitoring (CSQM1 and CSQM 2)

As of December 15, 2023, CSQM 1 and CSQM 2, will apply to related services engagements, which includes compilation and trust engagements.

Canadian Standard on Quality Management (CSQM) 1: This standard will replace CSQC 1 and is focused on quality management for firms that perform audits or reviews of financial statements, other assurance or related services engagements, which will notably include compilation engagements. Therefore, many sole practitioners and small firms will, for the first time, need to design, implement and operate a system of quality management. As a note, related services engagements do not include tax and consulting services that may be offered by a practitioner, but will include legal and real estate trust engagements.

Canadian Standard on Quality Management (CSQM) 2: This standard is focused on the importance of the role of Engagement Quality Reviews (EQR), currently referred to as Engagement Quality Control Reviews (EQCR). CSQM 2 has been extracted, updated and expanded in a stand-alone standard which is currently included in CSQC 1. This standard emphasizes the importance of the engagement quality reviewer’s role and discusses the appointment and eligibility of an engagement quality reviewer, along with enhanced performance and documentation requirements of the EQR.

As many sole practitioner and small firms have not had to implement a quality standard in the past, it is highly recommended that these practitioners understand the new standards and how the standards will need to be implemented. Practitioners should review the Handbook, attend professional development courses, and refer to CPA Canada’s CSQM resource page for further guidance.

Compilation Engagements (CSRS 4200)

The new compilation engagement standard was effective for periods ending on or after December 14, 2021. As this standard represents a significant departure from the previous Section 9200, this continues to be a key focus area of the PRP.

Here are a few things to remember with respect to CSRS 4200:

- There are scope exclusions for when certain services being performed do not require the completion of a compilation engagement (CSRS 4200 paragraph 2). Practitioners should ensure they fall within the scope of the standard when preparing financial information.

- File documentation must meet the requirements of the standard (CSRS 4200 paragraph 22-35). The documentation includes acceptance/continuance requirements, knowledge of the business, basis of accounting and note disclosure.

- The new compilation report includes responsibility paragraphs (related to management and the practitioner) along with the nature and scope of the compilation engagement (CSRS 4200 paragraph 37-38).

A core element of the new standard is a note describing the basis of accounting applied in the preparation of the compiled financial information. The basis of accounting note is to assist users in understanding how the financial information was prepared. It is important to note that the selection of the basis of accounting is the responsibility of management.

Cryptocurrency

Entities in the cryptocurrency industry or holding cryptocurrency assets have unique characteristics and risks. The most popular and widely held cryptocurrency is Bitcoin. The value of Bitcoin continues to fluctuate significantly due to significant turbulence in cryptocurrency markets and the current macroeconomic environment. As a result, practitioners should perform assessment for impairment at the end of each reporting period.

Entities engaged in crypto asset mining are complex, high-risk and involve difficult-to-verify virtual assets. Experts in information technology may be required for the successful execution of these assurance engagements.

Tax Engagements

In order to support clients in dealing with CRA, as a best practice, all tax issues identified during the preparation of the returns should be documented by practitioners in the file. There should also be documentation to support the eligibility of various expenses and deductions.

Inspection of tax engagements are typically performed at a high level for compliance and accuracy of the information included in personal (T1) and corporate (T2) income tax returns. In order to further protect the public and support the knowledge and proficiency of members, PROs will continue to focus on the following key areas where documentation should be included:

- The tax documentation supporting shareholder balances and knowledge of the related tax impact.

- Appropriate support for rental and business activities in personal income tax returns.

- Appropriate completion of the GIFI on corporate income tax returns.

- Eligibility of business-use-of-home expenses claimed in personal income tax returns.

Practitioners are reminded of Rule 205 in the CPABC Code of Professional Conduct, which requires that members do not sign or associate themselves with any letter, report, statement, representation or financial statement which they know, or should know, to be false or misleading. If practitioners note any items during the preparation of a client’s tax return that may appear to be false or misleading, they should raise the item with their client in a timely manner and ensure they are satisfied with their client’s response before continuing the engagement.

Rate this Entry

Current rating: 2 yes votes, 1 no votes