The purpose of the Practice Review Program is to protect the public through assessing firms’ and practitioners’ compliance with professional standards, and by taking appropriate follow-up or remedial action in cases where firms are not meeting the standards. The Practice Review Program also provides an educational experience to firms.

The focus of the program this past year has continued to be on integrating all legacy bodies into the CPABC Practice Review Program. In particular, the program has been focused on ensuring that firms who perform audit and review engagements are executing procedures that are responsive to the entity’s risks and appropriately documenting those procedures. Another area of focus is the risk-assessment procedures in audit engagements, particularly in obtaining an understanding of controls and their effectiveness when a substantive approach is used.

Practice Review Results

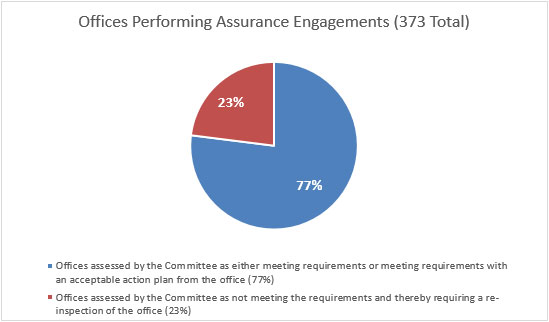

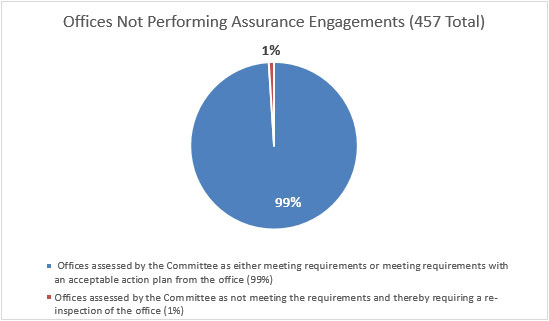

For the 2016-2017 inspection year, 830 offices were inspected. The overall pass rate was 89% (as compared to 91% in the prior year), with 11% of the offices being assessed by the Public Practice Committee (the Committee) as not meeting the requirements of the Practice Review Program. Of the total 830 inspections completed, 373 of the offices performed assurance work and the remaining 457 offices did not perform any assurance engagements.

For the firms that performed assurance work and were assessed as not meeting the standards of the Practice Review Program, there were some notable findings:

- Many of these firms performed engagements outside their core area of practice or in an area where they did not have substantial previous experience. Examples of this would be a firm that primarily does compilation and tax work performing its first review engagement, or a firm that focuses on not-for-profit clients performing an audit of a private company.

- A significant number of these firms lacked sufficient documentation in their review and audit files, often filling in checklists using “Y” or “N”, with no other explanations of work performed or the results or conclusions on their work performed.

Areas of Focus for Practitioners

I. Review Engagements

One of the underlying causes behind the significant deficiencies identified in review engagements is insufficient documentation. Many firm responses indicate that matters were discussed with the client, but had not been documented, which is not sufficient to meet the documentation standards.

Another key issue was that, when analytical procedures were performed, they were often done at a superficial level, which resulted in insufficient enquiries of management. When enquiries are made, sufficient professional skepticism needs to be given to replies from management when these replies are inconsistent with other information in the file.

The primary areas where documentation and/or performance of the inquiry, analytical procedures, and discussion in files inspected needs to be improved are as follows:

- Inter-relationship/comparison of revenues, expenses, gross margin, operating ratios, and balance sheet items.

- Cut-off of accounts payable and enquiries for any unrecorded liabilities.

- Completeness of payroll and related accruals.

- Inventory valuation, client’s count procedures, and cut-off, especially when there is a risk that some items are slow moving.

- Valuation and classification of accounts receivable, particularly when there are related party balances or collectability issues.

- Sales cut-off, particularly when an entity is a contractor or would otherwise use the percentage of completion method to recognize revenue.

- Evidence of work performed to determine if the entity’s classification of preferred shares as either debt or equity was appropriate.

- Discussions with management and performance of additional procedures regarding any potential contingencies, commitments, and subsequent events.

- The written representation from management was not effective as of the date of the review engagement report.

- No documentation of the assessment of independence and acceptance/continuance of an engagement.

II. New Review Engagement Standard (CSRE 2400)

Once the new CSRE 2400, Engagements to Review Historical Financial Statements, comes into effect on December 14, 2017, documentation will become even more critical. The new standard places greater emphasis on the practitioner’s professional judgement in recognizing circumstances that may cause the financial statements to be materially misstated. Greater documentation will be required around the practitioner’s understanding of the entity, specifically with respect to accounting systems and the identification of areas in the financial statements where material misstatements are likely to arise. Furthermore, a calculation of materiality will now be required.

III. Audit Engagements

A common theme behind many of the audit deficiencies raised by practice review is that the documentation of work performed was inadequate or not evident in the file. In many instances, documentation was not sufficient to enable an experienced auditor, having no previous connection with the audit, to understand the nature, timing, and extent of procedures performed; the results of those procedures and audit evidence obtained; and any significant matters that arose during the audit. In addition, when there were significant professional judgements made, the audit work performed and the basis of support for conclusions reached was not always documented.

Another area where many firms encountered deficiencies related to performing insufficient planning procedures, particularly around assessing risk by understanding an entity’s controls and assessing the effectiveness of these controls. Even if the audit approach does not rely on controls, understanding processes where controls may be insufficient or not working as described is still crucial to designing effective substantive procedures. Frequently, when deficiencies were identified with regards to poor design and execution of substantive procedures, the underlying cause of the poor design was due to the entity’s risks not being identified and assessed due to a lack of understanding of the client and its operations.

Additional areas where audit deficiencies were identified were as follows:

- Lack of documentation of fraud risk factors during audit planning, particularly in audits of smaller entities and not-for-profit organizations.

- Insufficient documentation and/or execution of substantive audit procedures on material classes of transactions and account balances in the following key areas:

- Accounts payable completeness and cut-off

- Payroll completeness, accuracy, and cut-off

- Revenue, particularly for long-term contracts and transactions with multiple elements

- Expense completeness and cut-off

- Accounts receivable valuation

- Collectability of loans receivable, particularly from related companies

- Classification of preferred shares as debt or equity

- Inventory count procedures and valuation

- Related party transactions

- Contingencies, particularly with respect to review of legal expenses and consideration of confirmations

- Journal entry testing

- Subsequent events review

- Going concern analysis

- When the audit approach required sampling, firms did not document the sample design, sample size and the rationale for the selection of items for testing.

- Requirements regarding communications with those charged with governance was often not adequate or sometimes not performed.

IV. Financial Statements

When insufficient work is performed in audit or review engagements, there can also be issues in the related financial statement disclosures. As an example, one of the most common financial statement deficiencies is when an entity’s significant accounting policy includes a template revenue recognition note. The note is frequently not customized to the entity’s actual operations due to the practitioner not having gained sufficient knowledge of the entity’s operations during the planning stage of its engagement.

Additional common financial statement deficiencies are as follows:

- Missing disclosure in related party transactions, particularly with respect to describing the relationship between the parties and the nature of the transactions.

- Debt obligations due on demand, including related party debt, inappropriately classified as long-term.

- Inappropriate classification of preferred shares that are not issued under a qualified tax planning arrangement. For preferred shares issued under a qualified tax planning arrangement, disclosure was often incomplete.

- Long-term debt often had missing elements of disclosure, particularly in relation to maturity dates, interest rates, and repayment terms. Furthermore, the carrying value of assets pledged as security for liabilities was often not disclosed.

- The note disclosure for Income Taxes was often missing or incomplete.

- Missing disclosure of the nature and extent of financial instruments, and credit risk, interest rate risk, currency risk and fair value, if considered a significant risk for the entity.

V. Quality Control Policies and Procedures

Many firms that perform assurance engagements utilize one of the standardized Quality Assurance Manual (QAM) templates as the basis for documenting their quality control policies and procedures. While such templates are a useful starting point for the documentation of a firm’s policies, they should be tailored to meet the firm’s requirements and actual practices, while still remaining compliant with the requirements of CSQC 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance Engagements.

An important area that is frequently not tailored is the firm’s criteria for when an EQCR should be used for engagements. A firm should always ensure that it understands its areas of experience and the risk of its engagements in order to appropriately manage that risk.

Many firms are still not performing cyclical monitoring as required. Cyclical monitoring involves having an individual with appropriate expertise, who was not part of the engagement team, inspect at least one assurance file for each engagement partner. This is a way to get a fresh set of eyes on a file to identify any potential issues, and it is strongly advised to have this cyclical monitoring performed at least one year before a firm’s practice review so that identified issues can be remedied and files selected for practice review will reflect the improvements identified during the monitoring.

VI. Compilation and Tax Engagements

Firms typically include working papers in their files to support the figures in the compilation financial statements and to assist with ensuring that they are not associating themselves with false or misleading information. Practice review has encountered issues where working papers contained conflicting figures or information that had not been addressed or resolved. There are similarly issues when there is no supporting documentation whatsoever in the compilation engagement file to support the figures in the compilation financial statements.

Tax engagements encountered issues due to a lack of knowledge of compliance procedures, such as adherence to client’s filing deadlines, lack of retention of key documents, and not obtaining signed T183s from a client when the returns were e-filed.

Additional common deficiencies are as follows:

- Lack of documentation for an accountant’s consideration and assessment of independence, especially if bookkeeping services were provided.

- The financial statements contained notes that explicitly referred to GAAP.

- The statement of business activities and/or the statement of rental income in the T1 and/or the schedule 100 and 125 in the T2 did not include tax disclaimers indicating that the information was prepared solely for income tax purposes without audit or review of information provided by the taxpayer.

- No documentation within the file regarding foreign assets or income.

VII. Action Plans

Firms may be required to submit an Action Plan to CPABC in response to the reportable deficiencies raised during the inspection. CPABC provides an action plan template which can be found in the Practice Review section of the CPABC website. The template covers how the firm plans to address each deficiency, identification of root causes, and actions the firm will take to address the more systemic issues identified. Some actions which may be taken include professional development courses by partners and staff, updating checklists used within the firm, and increasing supervision of teams performing assurance work. When drafting an action plan, the firm is strongly advised to review the CPA Canada Handbook sections referred to in each deficiency to ensure that their response is appropriate.

Staff will evaluate the action plan to determine whether it is satisfactory and adequately addresses the deficiencies raised in the practice review. If it is unsatisfactory, the Committee may recommend that a firm have a re-inspection at a cost to the firm when one was not initially required. If a firm was already required to have a re-inspection, the Committee may recommend additional consequences, such as requiring a supervised practice or restricting the firm from accepting new engagements.

VIII. Analysis for Restatement

When a Practice Review Officer has identified a potential material error, the firm is required to perform an analysis to determine if there is a need to retract and reissue the financial statements. This analysis must be prepared in accordance with the relevant section(s) of the CPA Canada Handbook, with reference to appropriate supporting documents. A firm is responsible for ensuring that it consults or engages external specialists, if necessary, if it does not believe it is able to prepare an appropriate analysis on its own.

Similar to the action plan, the analysis for restatement is evaluated to determine whether it is satisfactory. An unsatisfactory analysis for restatement may result in similar additional consequences as unsatisfactory action plans, and may also include a requirement from the Committee that the firm engage an external specialist, at its own expense, to assist in preparation of the analysis and in any subsequent restatement and reissuance procedures.

Final Thoughts

Practitioners are strongly encouraged to practice in only those areas for which they have knowledge of the industry and sufficient experience with the standards. For those areas where they may lack expertise and knowledge, they are encouraged to consult a professional colleague to ensure that risks are being appropriately addressed or they may consider referring the engagement to a more experienced practitioner. In cases where firms were not meeting the professional standards, the practitioner was often considered to be “dabbling”. Practitioners often have the best intentions when accepting a one-off engagement (e.g., a special request by a long-term client) but find themselves not meeting professional standards and therefore subject to a re-inspection. It is important to practice only in those areas for which a practitioner is willing to invest the time and cost to stay current with the standards.

Rate this Entry

Current rating: 1 yes votes, 0 no votes