Financial Statement Presentation

Not-For-Profit Organizations (“NPOs”) receive a variety of different types of contributions [1]. Often times these contributions have restrictions on them which stipulate how they should be used. NPOs have an obligation to track restricted contributions to ensure they are expended correctly. A common financial statement presentation method used by NPOs to track restricted contributions is the use of Fund Accounting.

Fund Accounting

Fund Accounting[2] comprises the collective accounting procedures resulting in a self-balancing set of accounts for each fund established by legal, contractual or voluntary actions of an organization. Elements of a fund can include assets, liabilities, net assets, revenues and expenses (and gains and losses, where appropriate). Fund accounting involves an accounting segregation, although not necessarily a physical segregation, of resources.

Fund Accounting is an accounting policy choice an NPO can make in regards to its financial reporting. A NPO using Fund Accounting formally creates a number of different funds, which can reflect a variety of restrictions and are used to track contributions. As NPOs receive a variety of different donations, with numerous restrictions a NPO can choose which funds to establish, and not all externally restricted funds need the creation of their own fund. For example, some typical funds that are established are:

- unrestricted funds (the funds can be used for any purpose);

- restricted funds (the funds must be used for specific purposes);

- capital assets (where the funds are for capital assets); and

- endowment fund (where only income from the capital can be used);.

Within each of these larger funds, there may be smaller restricted funds that the NPO tracks internally, based on the restrictions specific to the donations. For example: if a donation is received for the purchase of computers, this would be included in the capital asset fund, but tracked internally to ensure only computers are purchased with the funds.

Regardless of whether an NPO chooses to apply Fund Accounting, the NPO must still keep track of their restricted contributions internally. Smaller organizations that do not receive restricted contributions, or receive infrequent and small contributions may choose not to apply Fund Accounting, and as a result, they would use the Deferral Method of accounting for contributions.

Funds can be shown as separate columns on the NPO’s Statement of Operations and Statement of Financial Position, or in the notes, or as a separate schedule attached to the financial statements.

Accounting for Contributions

The second part of this article discusses accounting for contributions. Besides choosing a presentation style for their financial statement, an NPO must also choose a revenue recognition policy for accounting for their contributions. There are two methods of accounting for contributions: the Deferral Method or the Restricted Fund Method. When an NPO chooses not to apply Fund Accounting then they must use the Deferral Method, but when Fund Accounting is applied, they have a choice between the two. Both methods are described below.

Deferral Method of Accounting for Contributions

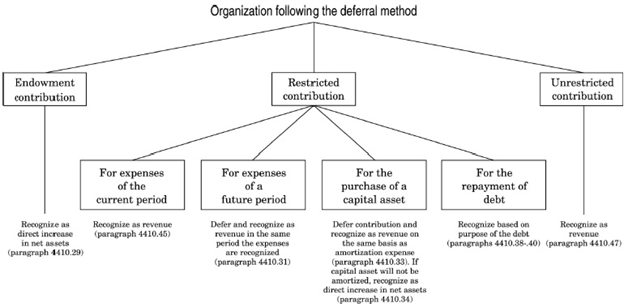

Deferral Method[3] Under the deferral method of accounting for contributions, restricted contributions related to expenses of future periods are deferred and recognized as revenue in the period in which the related expenses are incurred. Endowment contributions are reported as direct increases in net assets. All other contributions are reported as revenue of the current period. Organizations that use fund accounting in their financial statements without following the restricted fund method would account for contributions under the deferral method.

The Deferral Method of accounting is often seen as less complex and easier to maintain and is often used by smaller organizations or organizations that do not receive multiple restricted contributions. Depending on the type of contributions received, the accounting treatment differs and is outlined in the decision tree below.

Deferral Method Decision Tree[4]

Restricted Fund Method of Accounting for Contributions

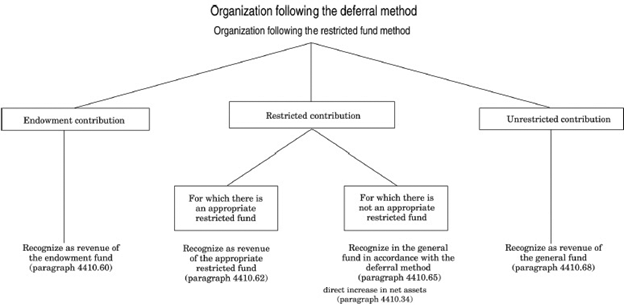

Restricted Fund Method[5] of accounting for contributions is a specialized type of fund accounting which involves the reporting of details of financial statement elements by fund in such a way that the organization reports total general funds, one or more restricted funds and an endowment fund, if applicable. Reporting of financial statement elements segregated on a basis other than that of use restrictions (e.g., by program or geographic location) does not constitute the restricted fund method.

The Restricted Fund Method of Accounting for contributions is a specialized type of Fund Accounting. An NPO following the Restricted Fund Method would report a general/operating fund, at least one restricted fund and an endowment fund. Depending on the type of contribution received, the accounting treatment differs and is outlined in the decision tree below.

Restricted Fund Method Decision Tree[6]

More resources

Footnotes

- Section 4410 – “A contribution is a non-reciprocal transfer to a not-for-profit organization of cash or other assets or a non-reciprocal settlement or cancellation of its liabilities. Government funding provided to a not-for-profit organization is considered to be a contribution. “

- Definition taken from the CPA Canada Handbook, Part III Accounting Standards for Not-For-Profit Organizations, Section 4400

- Definition taken from the CPA Canada Handbook, Part III Accounting Standards for Not-For-Profit Organizations, Section 4400

- Taken from the CPA Canada Handbook, Part III Accounting Standards for Not-For-Profit Organizations, Section 4400

- Definition taken from the CPA Canada Handbook, Part III Accounting Standards for Not-For-Profit Organizations, Section 4400

- Taken from the CPA Canada Handbook, Part III Accounting Standards for Not-For-Profit Organizations, Section 4400

Rate this Entry

Current rating: 28 yes votes, 12 no votes