Insights from the 2022 CPA Recruitment Needs Study

To better understand the CPA labour market in BC, CPABC commissioned a study by Deloitte in 2022. In conducting the CPA Recruitment Needs Study, Deloitte used economic modelling to project the demand for and supply of CPAs between 2023 and 2027. This article highlights the study’s findings.

The outlook today

The CPA Recruitment Needs Study found that demand for BC CPAs remains high, with CPA unemployment falling to record lows and job vacancies reaching an all-time high. The tightness of the CPA labour market mirrored that of BC’s labour market overall.1

As of June 2022, CPABC had over 38,000 members in good standing. Approximately 27,926 of these CPAs worked in BC, while the remainder worked in other parts of Canada or internationally. Those working in BC were employed in every region of the province and in every economic sector. The professional, scientific, and technical services subsector; the public administration subsector; and the finance, insurance, and real estate subsector employed the majority of CPAs in the province, and public practice accounted for approximately one-fifth (21%) of CPA employment.

Underscoring the tightness of the CPA labour market, the study found that approximately 830 positions meant for CPAs were unfilled as of the first quarter of 2022. While this number represented less than 3% of CPABC’s total membership, it reflected an increase in the number of vacancies over the previous few years—one that continues to prove challenging for employers today.

The forecast for 2023-2027

Given the significant economic challenges being experienced across the province, the Deloitte study forecasts that the economy will continue to grow in 2023 but at a slower pace due to challenges that include supply chain disruptions, labour shortages, and efforts to rein in inflation.2

The study predicts that demand for CPAs in BC will grow at an average annual rate of 1.3% between 2023 and 2027. This is a slower growth rate than we’ve seen in recent years and reflects a general slowdown in growth expectations for BC’s workforce overall.

Even so, it’s important to note that the demand for CPAs over the last several years has been remarkable. In fact, employment in professional, scientific, and technical services—the subsector that is the single-biggest employer of CPAs—saw relatively few job losses during the economic downturn in 2020. Overall employment (CPA and non-CPA) in this subsector grew by 10.8% in 2021—one of the largest gains across all industries. Growth was also very strong in 2022, with employment in this subsector increasing by 12.6% between October 2021 and October 2022.

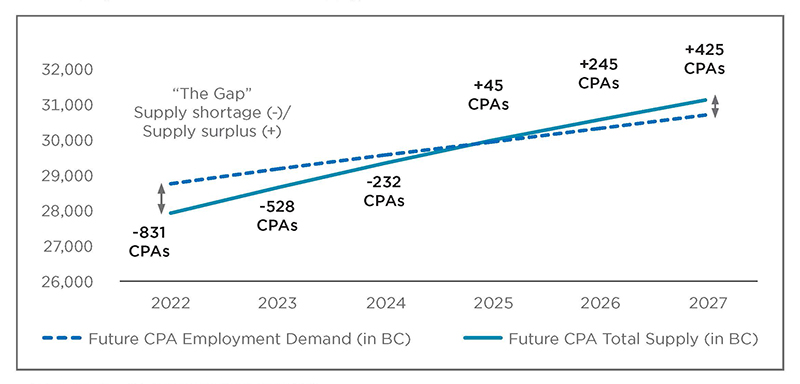

The rate of CPA supply growth is actually expected to exceed demand growth over the next five years, with the supply of CPAs in BC growing at an average annual rate of 2.2% between 2023 and 2027. The primary source of this growth is expected to come from new CPA admissions (i.e., candidates who have completed the required work experience and passed the CFE). As a result, even though the labour shortage of CPAs is forecast to be approximately 528 in 2023 (see graph below), with the unemployment rate for many CPA occupations below 2%, this shortage is expected to shift to a very small surplus of CPAs beginning in 2025.

However, given the significant shortage today, the relatively slower demand growth will not have a significant impact on the CPA outlook over the next five years. Even the 425 surplus CPAs expected at the end of 2027 would represent a very low unemployment rate of about 1.4%. For comparison, BC’s unemployment rate in October 2022 was 4.2%, and the province still faced record labour shortages. In short: The labour market is expected to stay very tight.

CPA Employment Demand and Total Supply, 2022-2027

Source: Deloitte, CPA Recruitment Needs Study, 2022.

Notable trends

Two trends in BC are likely to keep the CPA unemployment rate low and the CPA labour market constrained. First, BC’s population is aging quickly, and this demographic shift is expected to spur demand as employers look to replace CPAs who retire.3 Second, given the significant labour shortages in all economic sectors, the profession faces stiff competition from other industries for prospective and current CPA candidates.

It’s important to note that the study’s supply and demand forecast model relies on the rate of new CPA admissions totalling approximately 1,100 per year. If there are fewer admissions than assumed in the model, the labour shortages over the next few years could actually widen, and the potential small surplus expected by 2025 could evaporate. Conversely, even if new CPA admissions increase to 1,200 in the later years of the forecast (2025-2027), the estimated CPA unemployment rate would remain below 2% of total supply by 2027, which suggests that there is room remaining for further supply growth.

Dealing with labour shortages

Employers looking for immediate relief from the CPA labour shortage are unlikely to find it, as a significant portion of the demand both now and in the near future is for mid- and senior-level positions, which poses a two-pronged conundrum: 1) these vacancies can’t be filled by new or current CPA candidates, as they take an average of three to four years to become certified; and 2) if internal staff are promoted to fill these vacancies, employers could find themselves short-staffed at the entry level.

This connects to another potential challenge: the impact of the CPA labour shortage on existing CPA employees. For example, employers who are unable to fill vacancies may have to burden existing workers with more responsibilities, which could lead to burnout and apathy. The inability to find enough CPAs to fill roles could also limit organizations’ ability to produce their goods and services effectively or expand their business operations.

Given the considerable length of time it takes CPA candidates to earn the designation, an increase in the supply of CPAs (student recruitment) will not alleviate the challenges employers face today or in the short term. This means that approaches beyond student recruitment, such as efforts to attract and retain CPAs, will be required to adequately meet the demand for CPAs in BC.

When it comes to retention, organizations do have some mechanisms at their disposal. For example, employers who are struggling to attract or retain CPA employees would do well to focus on the top three job priorities identified by CPAs in 2022: 1) competitive compensation, 2) work-life balance, and 3) organizational culture.

CPA market response

Overall, the 2022 study found that although the current CPA shortage is expected to ease moderately over the next five years, the labour market is expected to remain tight, which means ongoing challenges for employers. Further, as the unpredictability of the past few years has very clearly shown, any forecasts about the CPA labour market in BC are subject to a number of risks and trends.

As noted in the cover story of the January/February 2023 issue of CPABC in Focus, awareness of these uncertainties is informing the CPA profession’s work. The Certification 2.0 Steering Committee is keenly aware of the ongoing need to supply the market with highly trained CPAs. CPABC, too, will continue to contribute to the work under Certification 2.0 while carefully assessing these supply and demand issues and adapting accordingly.

Aaron Aerts is CPABC’s economist.

This article was originally published in the January/February 2023 issue of CPABC in Focus.

Footnotes

1 For more on BC’s overall labour market, see: “Work in BC,” CPABC in Focus, November/December 2022 (14-22).

2 Deloitte’s macroeconomic forecast for this study was completed in July 2022. It incorporates interest rate hikes and expectations up to that point in time.

3 For more on demographic trends in BC, see: “The High Cost of Living in BC,” CPABC in Focus, July/August 2022 (14-24).