In our podcast episode, Lori Mathison, FCPA, FCGA, LLB, president and CEO of CPABC, and Sarah Marsh, CPA, CA, partner with PwC Canada’s Sustainability and Climate Change team in Vancouver and national lead for their ESG Reporting group, discuss why it’s important for CPAs to understand ESG and the critical role they can play in ESG reporting. Part of our Coffee Chats with CPABC podcast series.

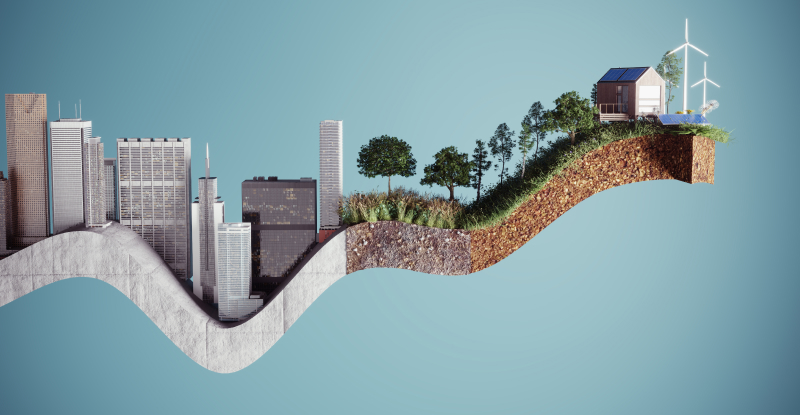

With the extreme weather we’ve experienced in BC throughout 2021, it is evident that everyone has a role to play in ensuring environmental sustainability for the future. And organizations that embrace all aspects of ESG, environmental, social and governance, have the opportunity to not just minimize risk but also create true value and opportunities. CPAs have a critical role to play, including developing organizational strategy, ensuring coordinated execution, and applying appropriate governance and reporting practices, all with the highest ethical standards.

CPABC has been producing ESG content to support our members in understanding and incorporating ESG efforts into their practices. In my previous editorial on understanding the need for an ESG strategy, I mentioned that it is clear that we need to normalize and integrate ESG into how we do business and discussed how an ESG strategy could be developed for risk-mapping purposes to manage the broadest range of risks. Mia Maki, FCPA, FCMA, also provided a more in-depth explanation of how the doughnut economic model can be used as a tool to map ESG principles.

These articles helped set the stage for the importance of ESG in general, and in my latest podcast with Sarah Marsh, CPA, CA, partner with PwC Canada’s Risk Assurance Services practice in Vancouver and national lead for their ESG Reporting and Assurance Practice, we take a closer look into why CPAs should focus on developing a better understanding of ESG and how they can play a critical role in shaping their organization’s ESG strategy and define ESG reporting. Here are some of the highlights.

Why is ESG important and why we are hearing more about it now than ever before?

Sarah: Climate change disruptions, such as the recent floods and mudslides in BC, are threatening the future sustainability of the planet. And in turn, these disruptions pose huge challenges for our governments and businesses, as they need to adapt to respond to these new conditions.

As a result, we are starting to see fundamental shifts in how businesses view the importance of an ESG strategy: organizations not only need to effectively manage ESG risks, they need to understand how to find opportunities from disruption.

Investors have clearly recognized this, and they’ve been leading the charge in demanding more information in these areas so they have a realistic chance of assessing a company's approach and performance. In fact, in our 2016 CEO survey, only 39% of asset wealth management CEOs we surveyed were concerned about the threat posed by climate change. Fast forward five years later, over 70% are expressing this concern, illustrating the point that ESG is not going away anytime soon.

How do you think the growing focus on ESG will affect the CPA profession and how important is it for CPAs to be part of these discussions?

Sarah: What's fundamentally changed around this conversation on sustainability or ESG, is the growing evidence that strong performance of ESG factors is tied to strong long-term financial performance. When it comes to attracting capital and obtaining financing, ESG information is becoming key and central to many of those discussions. For example, we’ve seen a lot around sustainability linked-loans and green bonds. From this perspective, it becomes clear that CPAs need to be front and centre in these kinds of discussions.

Generally, CPAs know they play a fundamental role in the capital markets when providing trustworthy information to help shape decision making. And with the rewiring of the capital markets and organizations using broader information to make investment decisions, CPAs are well positioned to help now. And personally, I felt that with my CPA training, I understand well how financial statements are used to support the capital markets, and so there's a natural linkage to understanding how ESG information is being used, which in turn, has been really helpful in shifting these conversations towards ESG-based decisions

How can CPAs play a critical role in integrating ESG into business planning and processes?

Sarah: We used to have one sustainability and climate change team at PwC Canada, and outside of that team, no one else really dealt with ESG. It was considered a niche business area. Today, this team is expanding rapidly in response to increasing demands from our clients.

The other thing that's happening is that ESG is being embedded into every line of our service and every department. Whether it’s fair share of tax, impact of climate on accounting estimates, due diligence services being expanded to cover ESG factors, or systems implementations in future covering both financial and ESG data, it’s clear that every facet of our service offerings will need to consider ESG.

The same thing is true for all CPAs. When you think about making capital purchase decisions, in the past, the financial cost was probably the most fundamental element to consider. Perhaps you'd think about quality too, but rarely the carbon impact of your investment.

But today, factors such as the carbon impact of an investment will drive your capital purchase decision, as you will want to ensure investments help your organization fulfill its net zero ambitions. And you can’t make these types of informed decisions without understanding ESG. So for these reasons, CPAs have to upskill.

ESG initiatives will become more mainstream and integrated into organizational strategy in the short-term. And we can also expect more and more investors’ expectations to shift to an ESG focus. This means that ESG reporting could be a huge opportunity for CPAs – what are your views on that?

Sarah: What we've seen during this pandemic is a huge shift in the target audience that organizations deliver their ESG and sustainability reporting to. In the past, the sustainability report was addressed to many stakeholders in your company, but it often wasn’t targeted at investors.

That target audience has changed and so has the use of the report, with an increased reliance on it for investment purposes. Investor grade reporting is a phrase we've been using, because it really helps those who are just coming across ESG for the first time understand what this shift is, and the difference between the old corporate social responsibility and sustainability reports, and the new reporting.

What we're seeing more and more is that CPAs have a real role to play, because they can bring the rigor that they’ve been using in financial reporting to non-financial information. Specifically, CPAs are able to use the processes and controls they’ve built in reporting to disclosure committees, to quality reporting of ESG.

On that topic, PwC Canada has recently launched the 2022 Canadian ESG Reporting Insights, a first-of-its-kind analysis exploring the quality of ESG reporting among Canada’s top 150 public companies and helping leaders benchmark their organizations against sector peers.

Listen to the full podcast episode to learn more about why understanding ESG is critical to CPAs.

Lori Mathison, FCPA, FCGA, LLB is the president and CEO for the Chartered Professional Accountants of British Columbia (CPABC).