A lot has changed over the last three years, with onset of COVID-19 and its continual impact around the world. What remains unchanged is the December 31 deadline for capital property transactions. This is important to note if you wish to sell capital property and apply the gains or losses to your 2022 tax return.

Capital property includes tangible property such as real estate, vehicles, stocks, bonds, cryptocurrencies, collectibles, and art, as well as intangible property such as patents and trademarks. Generally, if you sell this type of property for more than what you originally paid, you have a capital gain; likewise, if you sell for less than the original cost, you have a capital loss.

Whatever the outcome, you are required to report all capital property sales in your income tax return. In Canada, capital gains have a tax advantage over other types of income as you’re only taxed on 50% of a capital gain. Capital losses can be used to offset capital gains so that you’re taxed less. How can you best use capital gains and losses to reduce your taxes owed? The first step is determining if you have capital property.

What qualifies as capital property?

Capital property is generally used to generate long-term income, such as real estate that earns rental income, investments, and equipment used to run a business. If you have a laptop that you’re using to run your business, the laptop will be considered capital property. But if you’re planning on selling laptops as part of your regular business activity, the laptops will be classified as income-producing property, not capital property.

What about personal property? Certain capital property is considered personal-use property such as cars and boats, if you own them primarily for personal use. In most cases, you do not end up with capital gains as these types of assets usually decrease in value.

But in the case of real estate transactions, you must report the sale on your income tax return whether the sale resulted in a gain or a loss. If there is a gain, you may not be taxed on this gain if the home was your principal residence. Failing to report the sale of your principal residence could result in the entire gain being taxable and could be subject to some significant penalties.

Alternatively, if you sold your summer vacation house, a capital gain on that home would be taxable. What if you flipped a home? If you purchased it with the sole intention of renovating it to sell, it is not considered capital property, much like if you sell laptops as part of your regular business activity.

What’s the capital gains tax advantage?

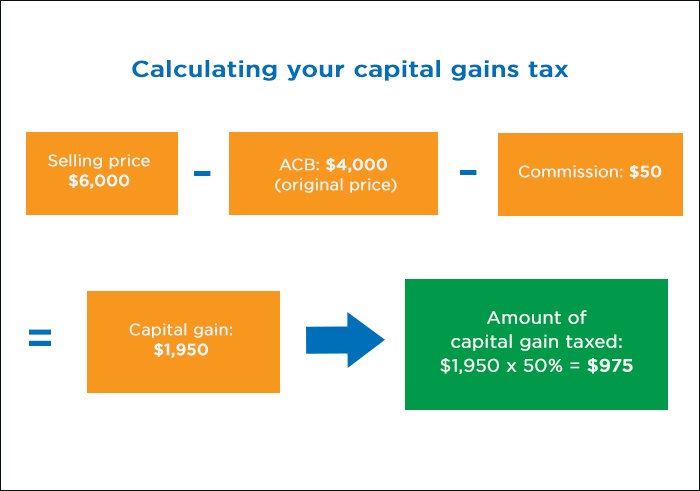

Let’s say you originally bought shares in a company for $4,000. This is known as the adjusted cost base (ACB).

A couple of years later, you sell your shares for $6,000. You also incur some expenditures in selling your capital property, such as a $50 commission fee to sell your shares. You are allowed to deduct this fee from the proceeds when calculating your gain.

As a result, your total capital gain will be your selling price ($6,000) minus your ACB ($4,000) minus your selling costs ($50), which totals $1,950. As mentioned earlier, you are only taxed on 50% of a capital gain, which would equal to $975 in this scenario.

How do capital losses benefit me?

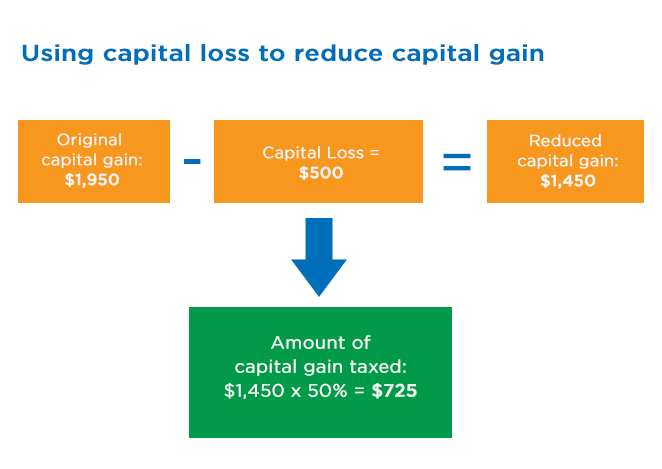

Unlike capital gains, capital losses don’t directly impact your income. For example, if you sold capital property for less than your ACB, your regular income won’t be reduced. However, if you also had a capital gain that same year, you can use your capital loss to offset your capital gain, thus reducing the amount of income tax you need to pay.

The hard rule is that if you experience a capital loss the same year you have a capital gain, you must use your capital loss to reduce your capital gain in the same year.

For example, if you have a capital gain of $1,950 from selling a stock, but you also have a capital loss of $500 from selling some cryptocurrency during the same year, you can deduct that $500 from your $1,950 gain – meaning your capital gain will be reduced to $1,450 and be taxed 50% which would equal to $725.

But what if you had a capital loss this year, but no gain? You can choose to carry back your capital loss up to three years prior, offsetting any capital gains incurred during any of these years, which could lead to a tax refund. To do this, you would need to fill out Form T1A (Request for Loss Carryback) on your personal income tax return. Alternatively, you can hang on to your capital loss from this year and use it to offset a capital gain in the future. There is no time limit as to how far you can carry a capital loss forward.

Residential Property Flipping Rule

The 2022 Federal Budget proposed a new rule that any individuals who sell residential real estate owned for less than 12 months could be subject to full taxation on the profits. The profits would not be eligible for either capital gains rates or the principal residence exemption, however there are several exemptions to this rule such as death, disability, employment change, etc. This new rule applies to residential properties sold after January 1, 2023.

Are there any exemptions to the capital gains tax?

There are some exemptions for qualified small business corporation shares and qualified farm or fishing property for Canadian residents. This includes taxpayers who became residents partway through the taxation year in question. As the exemptions can be complicated, consult a chartered professional accountant to determine whether your property qualifies for the lifetime capital gains exemption and to answer any other questions you may have about capital gains and losses.

The bottom line

If you make a profit from selling capital property, you need to report it. Since you’re only taxed on half of the capital gain, paying this reduced tax far outweighs the risks of not reporting your gain. Don’t forget that any capital gains or losses for your 2022 tax return must have been made within the 2022 calendar year, or by December 31, 2022.

Author

Bilal Kathrada, CPA, CA, is a partner at Clearline Chartered Professional Accountants specializing in income tax and succession planning for Canadian owner-managed businesses in various industries. Bilal is a member of the CPABC Taxation Forum and CPABC’s media expert on RRSPs and income tax filings.

Visit the personal finance section of CPABC's newsroom for more tax tips.