WorkSafeBC is proposing to return approximately $570 million of surplus funds to employers through reduced rates. In this article, WorkSafeBC’s head of finance and assessments and chief financial officer highlights some key information and addresses some misconceptions.

BC employers fund the workers’ compensation system and pay close attention to premium rates and the financial management of WorkSafeBC. Employers—and CPAs who serve as their strategic advisors—want to know that the system is financially sustainable and that premium rates are fair and stable.

Rate stability is a primary goal

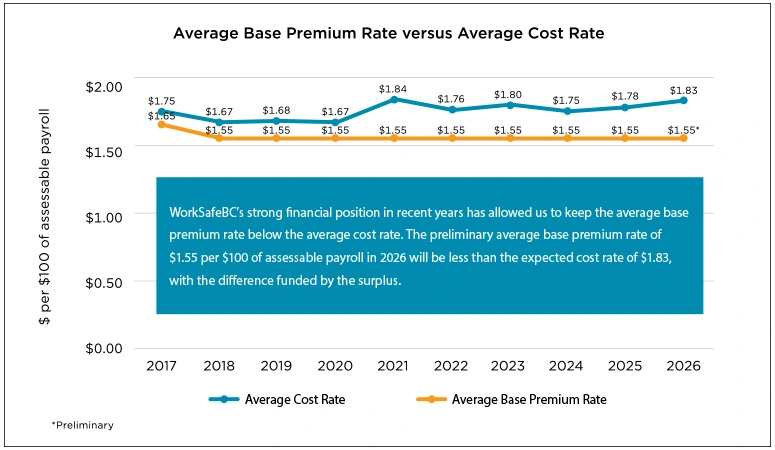

In recent years, WorkSafeBC has been able to support increased benefits for injured workers while keeping rates stable for employers. The average base premium rate has remained flat in BC since 2018. In fact, the preliminary average base premium rate for 2026 ($1.55 per $100 of assessable payroll) will be less than it was a decade earlier ($1.65).

However, given the economic uncertainties currently facing the province, WorkSafeBC has made temporary changes to the maximum increases and decreases in the 2026 rates for BC industries, which have normally been capped at 20%.

For 2026, rate increases will be capped at 10%, while rate decreases will be allowed to reach up to approximately 40%. This change is designed to provide greater rate stability for employers across BC during tough economic times.

Surplus funds are being returned to employers

In recent years, the WorkSafeBC surplus has garnered attention from several employer groups, and we’ve received calls to rebate the surplus to employers. We’ve learned from our discussions with these groups that WorkSafeBC’s surplus—and its role in keeping rates stable—is not well understood.

In fact, WorkSafeBC’s rate-setting approach already includes mechanisms to return surplus funds to employers when the funding level exceeds its target. In 2026, for example, WorkSafeBC is proposing to return approximately $570 million of surplus funds to employers by pricing premium rates below costs.

We project that between 2019 and 2026, WorkSafeBC will have returned $3 billion of surplus funds to employers by pricing premium rates below the cost to run the workers’ compensation system. The reality is that if WorkSafeBC rebated the surplus to employers, rates would need to steadily increase in subsequent years to cover the actual costs of operating the system.

The strategy of charging below cost to provide insurance coverage is the primary reason why WorkSafeBC’s funding ratio has dropped from a high of 155% in 2021 to 141% at the end of 2024.

There are challenges ahead

WorkSafeBC is seeing upward claim-cost pressures and a more volatile investment market, which means our past good fortunes in generating excess investment returns are less likely to continue.

The future cost pressures are the result of an increase in the number of claims with complex injuries, such as psychological injuries and chronic pain. These claims generally have higher costs, as they tend to be longer in duration and require more health-care services.

On the positive side, WorkSafeBC continues to be financially sound, and the overall injury rate has been improving. Looking ahead, we will continue to closely monitor cost pressures and keep rates as stable as possible.

Premiums fund the workers’ compensation system

The Workers Compensation Act requires WorkSafeBC to set premium rates annually for employers to pay for the workers’ compensation system. The system is structured so that today’s employers are accountable for the full cost of today’s workplace injuries.

Annual base premium rates are driven by provincial injury rates, return-to-work performance, and the resulting cost of claims, as well as investment performance relative to required rates of return.

WorkSafeBC operates a not-for-profit system funded solely by employer premiums and investment returns. Premiums fund the costs associated with work-related injuries and diseases, health care, wage loss, rehabilitation, and administration, including prevention and safety initiatives.

WorkSafeBC’s Board of Directors will finalize the 2026 premium rates in November 2025.

Mark Heywood, CPA, CA, is the head of finance and assessments and chief financial officer at WorkSafeBC.

This article was originally published in the September/October 2025 issue of CPABC in Focus.