Canadian businesses have spent the last few months pivoting on-the-fly as U.S. President Trump’s tariffs were proposed, rescinded, implemented and threatened yet again. Trump’s inconsistent approach to tariffs has left business owners scrambling to make prudent, growth-oriented decisions in a chaotic and unstable economic environment.

We spoke with David-Alexandre Brassard, CPA Canada’s chief economist, about how Canadians can build a solid financial business plan against the backdrop of unpredictable tariffs.

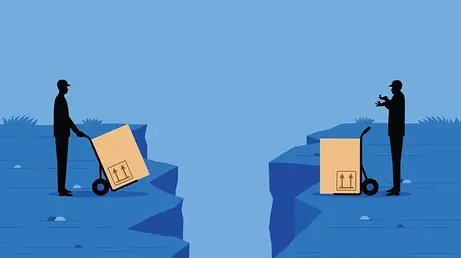

Review your supply chain and existing sales contracts

Steel and aluminum tariffs have impacted supply chains for critical materials and infrastructure. Use this time to review your existing supply and sales contracts for any clauses about price exemptions or even terminations due to tariff-inflated costs. By pivoting supply and sales agreements to domestic partners, you’ll reduce the impact that tariffs will have on your supply chain.

Simply put, cut out the imports and save money by keeping more of your supply chain within Canada. On top of making fiscal sense, shifting to Canadian-based suppliers aligns your business values with the “buy Canadian” consumer sentiment that’s swept across the country.

“The buy Canadian movement seems voluntary, which could mean that it’s not simply a blip on the radar,” says Brassard. “Businesses can build on that movement by favouring Canadian suppliers and informing their clients of their pro-Canada positioning.”

You can subsequently brand your business as a proud supporter of local industry, attracting more demand amidst the rising swell of Canadian pride. Marketing your goods and services as made-in-Canada can garner more brand interest, and ultimately, higher domestic revenue.

Run financial scenarios to project profitability impact

The Canadian government is promising retaliatory measures for each tariff that undermines the CUSMA free trade agreement. While Canada must stand firm in its resolve—elbows up—the escalating tit-for-tat tariff war will ultimately hurt Canadian businesses and consumers. Unfortunately, there’s no way to predict how long it will take before retaliation and escalation cause Trump to back down.

“GDP will drop more; we will lose more jobs and inflation will increase,” says Brassard. “The idea behind retaliation is to even out the conditions for businesses north and south of the border. By spreading economic implications, Canada is hoping that it leads the U.S. administration to rethink their trade policy.”

To help offset the uncertainty, construct tiered financial scenarios that calculate the long-term effect of tariffs on profitability. Forecast a best-case, conservative and worst-case scenario for your business. Use metrics of time, such as three-month, six-month and annualized brackets for how long Canada and the U.S. could be locked into a trade war. Prepare for each scenario so today’s fiscally sound decisions prepare you for any future possibilities.

Diversify your sources for parts, labour and services

Investing more of your supply chain in domestic sources reduces the amount that import tariffs affect your operating budget. However, while bringing more contracts closer to home, don’t put all your eggs in one provincial basket.

With agreements between Ottawa and the provinces to reduce interprovincial trade barriers, you could save more money through a transnational supply chain. Parts for one product may be cheaper in the Maritimes, whereas another service may be more cost-effective in British Columbia. With fewer interprovincial trade barriers, a nationally diversified supply chain helps lower your total operating expenses.

Interprovincial trade flows make up 36 per cent of total trade, compared to international trade flows of 64 per cent. “Improvements we make on interprovincial trade are certainly beneficial,” says Brassard. Lifting the interprovincial trade barriers that are estimated to be the equivalent of tariffs of 7 to 15 per cent could help.

Revisit your pricing and positioning strategies

The Bank of Canada’s forecast at the beginning of 2025 anticipated robust GDP growth and steady inflation for Canada. Unfortunately, the summary of deliberations and meetings in advance of a March monetary policy decision highlighted decreased consumer confidence and pullbacks in consumer spending. “Consumers are indeed reacting to the uncertainty by stockpiling savings, which in turn means less discretionary spending,” says Brassard.

While it means making less money per sale, lowering prices for business goods and services will maintain some forecasted revenue throughout the Canada-U.S. trade war. Making some money is better than making no money at all. Combined with efforts to lower your supply chain costs, these revised pricing strategies will reduce the brunt of the tariff impact on your business. You can also update your positioning strategy to highlight your immersion in Canadian supply chains and infrastructure, capturing more demand for Canadian-made products.

Seek opportunities to flourish through the chaos

Adaptability is the core tenet of any successful business owner or manager. Trade wars unquestionably represent real challenges to traditional business pillars, but they also incentivize innovation and new paths to experience growth.

“There are no real long-term benefits to tariffs,” says Brassard. “Consumers pay more for goods and services, and growth is negatively impacted by not allowing competition and comparative advantages to reign supreme.”

But in the midst of chaos, there is also opportunity. With Trump proving to be a demonstrable agent of chaos, use these unprecedented times as incentive to reframe your business and pivot into a new era of growth that’s firmly in your control as a Canadian business leader.

Originally published by CPA Canada.