Homebuyers are wary, affordable housing remains out of reach, and residents are looking to call other provinces home

CPABC recently launched its BC Check-Up: Live report, the second in its triannual series on investing, living, and working in British Columbia. This latest iteration focuses on evolving migration trends and the impact of economic uncertainty on BC’s housing market.

Homebuyers stayed cautious as tariffs created economic turmoil

In 2024, few would have imagined that housing affordability would soon drop from its perennial spot as the most newsworthy topic related to living in BC. But fast-forward to today, and that’s where we find ourselves: Soaring housing prices have taken a back seat to slumping sales.

By the end of 2024, all signs pointed to a return to normal for BC home sales—this, after two years of below-average turnover as higher interest rates kept many buyers on the sidelines. Moderated borrowing costs had already led to a bump in housing activity during the second half of the year, resulting in 74,434 residential sales in 2024, an increase of 2.1% compared to 2023.

However, that momentum was derailed in early 2025 when the United States started a trade war with Canada by threatening and then imposing tariffs on most Canadian goods. The impact on home sales was swift: As of April 2025, 21,676 homes had been sold in BC (year-to-date)—7.9% fewer compared to the same period in 2024. Analysis from the British Columbia Real Estate Association estimates that uncertainty in the economy led to 3,000 fewer home sales during the first quarter of 2025.1

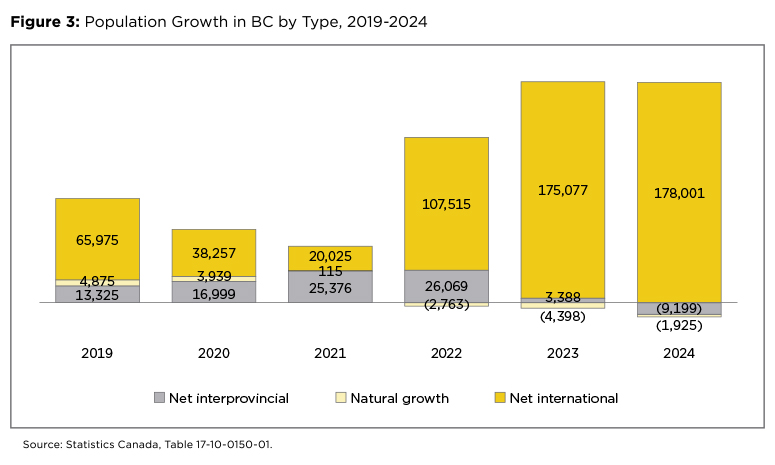

Home prices stayed flat despite more attractive interest rates

Despite the turbulence in the residential market, home prices have been relatively stable over the last year. The benchmark price of a home in BC was $953,500 in April 2025, down 1.3% from one year earlier (see Figure 1). Although this represents a 9.4% pullback from the March 2022 peak, the benchmark price is still 36.1% higher than it was in January 2020.

While the benchmark price alone doesn’t show much progress on the affordability front, we have seen improvements in terms of borrowing costs, which have become more attractive to prospective buyers. Mortgage interest rates have fallen since the Bank of Canada made a series of rate cuts that brought the policy interest rate down from 5.00% in May 2024 to the current rate of 2.75%.

At the same time, an increase in new listings has shifted the balance of power toward prospective buyers. According to a recent Royal Bank of Canada economics report,2 growing inventory and low sales have pushed both Greater Vancouver and the Fraser Valley into buyer’s market territory.

Nevertheless, many buyers remain hesitant.

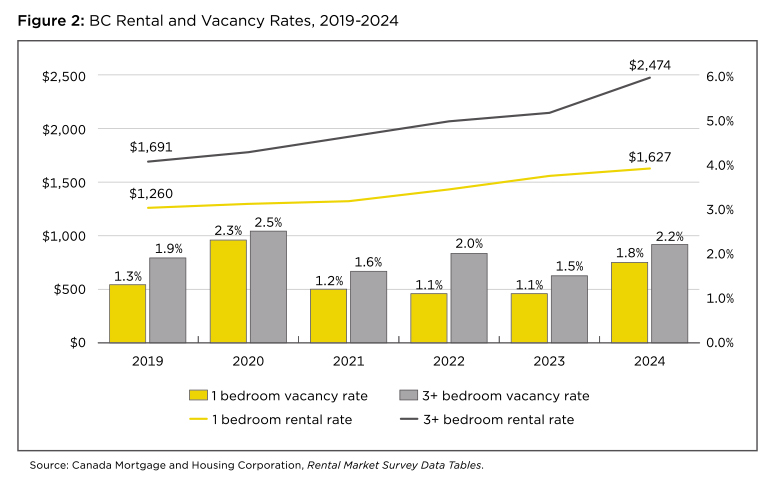

Rental prices increased

Despite the provincial government’s 3.5% rental increase cap for existing tenants in 2024, the average rental price across BC increased by 5.9%. While this actually marked a deceleration compared to the 8.5% increase seen in 2023, price growth remained higher than overall inflation over the same period.

The average monthly rent for one-bedroom units rose from $1,588 in 2023 to $1,627 in 2024, marking an increase of 4.4%; meanwhile, the average monthly rent for larger units with three or more bedrooms increased by 15.3%, reaching $2,474 (see Figure 2).

After falling to a record low of 1.2% in 2023, the provincial vacancy rate increased to 1.9% as more purpose-built rental units were completed.

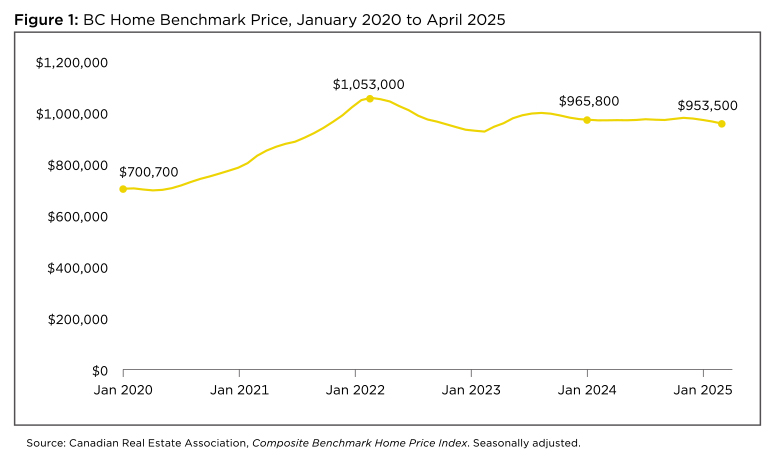

International influx tempered by new immigration target

As of July 1, 2024, BC was home to just under 5.70 million residents, a 3.0% increase from one year earlier. This amounted to a net increase of 166,877 people, which fell just short of the record increase of 174,067 experienced in 2023.

Immigration was the primary driver of population growth in the province for the third year in a row. In fact, BC welcomed a record-setting 178,001 international migrants3 in the year ended July 1, 2024 (see Figure 3). Meanwhile, natural growth and interprovincial migration reduced BC’s population.

To put the province’s population growth into perspective, BC gained 587,408 new residents between 2019 and 2024, representing an overall increase of 11.5%. By comparison, the province’s population grew by only 8.5% (or 398,331 residents) between 2014 and 2019.

Looking ahead, population growth is expected to slow as the federal government intends to admit fewer permanent residents between 2025 and 2027.4 In fact, its latest immigration plan set an overall admissions target of 1,140,000 new permanent residents over the next three years, bringing the annual total down considerably from the record number of 483,591 admitted in 2024. The plan also introduced a target for temporary residents and maintained a study permit cap that had been announced in 2024.

These lower targets have already made an impact. Based on the latest quarterly data, BC’s population growth slowed to 1.7% year-over-year as of January 1, 2025.

BC lost residents to other provinces for the first time in a decade (again)

In the July/August 2024 issue of this magazine,5 I highlighted the fact that BC’s interprovincial immigration had turned negative for the first time in a decade. The revelation that more British Columbians were relocating to other provinces—in particular, Alberta—signalled that unaffordable housing had finally begun to have a measurable impact on BC’s ability to keep or attract residents already living in Canada.

While the alarm bells continue to ring, revisions to Statistics Canada’s population estimates now indicate that BC gained 3,388 residents through interprovincial migration between 2022 and 2023, which means the province narrowly avoided a net outflow. As a result, 2024 now marks the first time in 11 years that BC lost residents to other provinces, as interprovincial migration reduced BC’s population by 9,199 people.

As in 2023, when BC lost 8,161 net residents to Alberta, BC’s biggest outflow in 2024 was to its provincial neighbour; 30,675 British Columbians relocated to Alberta last year, while only 18,290 Albertans made the opposite move. Compare this to BC’s net gain of 8,301 residents in 2022. Various surveys, including CPABC’s latest BC Check-Up: Live survey (see page 19), have found that poor housing affordability is contributing to this trend.

For the third year in a row, natural growth detracted from the provincial population count, as deaths outnumbered births by 1,925. This trend underscores the need for BC to improve housing affordability in order to attract new residents who can contribute to the labour force as the population ages and birth rates continue to fall.

Housing completions failed to keep up with population growth in BC’s largest cities

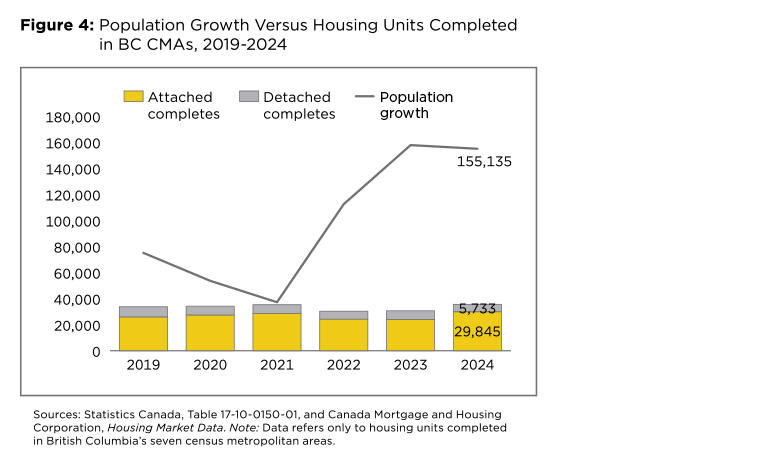

While new housing completions reached a record high in BC’s seven census metropolitan areas (CMAs)—where 93.0% of BC’s population growth occurred in 2024—the supply still fell short of meeting new demand. Specifically, completions climbed by 16.2% year-over-year to 35,578 units, but the population living in CMAs increased by 155,135 people, resulting in 0.23 homes per new resident (see Figure 4). The ratio of completions to population growth has fluctuated drastically since 2019, when the COVID-19 pandemic upended life in BC, including immigration.

Looking at the last five years as a whole, BC’s CMAs added 0.32 new homes per new resident, which is insufficient to maintain the average household size. Put more simply, population growth has contributed to the housing crisis, although it is not the only cause.

Not only has the number of new homes not kept pace with population growth since 2019, but construction has gradually shifted towards higher-density units. Attached housing units, such as apartments and row housing, made up 83.9% of all completions in 2024, up from 76.5% in 2019. While producing a greater number of smaller units is the fastest and most cost-effective way to increase the housing supply in cities where residential land is scarce, it does mean that more units need to be completed to meet the same level of population-driven demand.

Mortgage delinquencies crept up, but remained low by historical standards

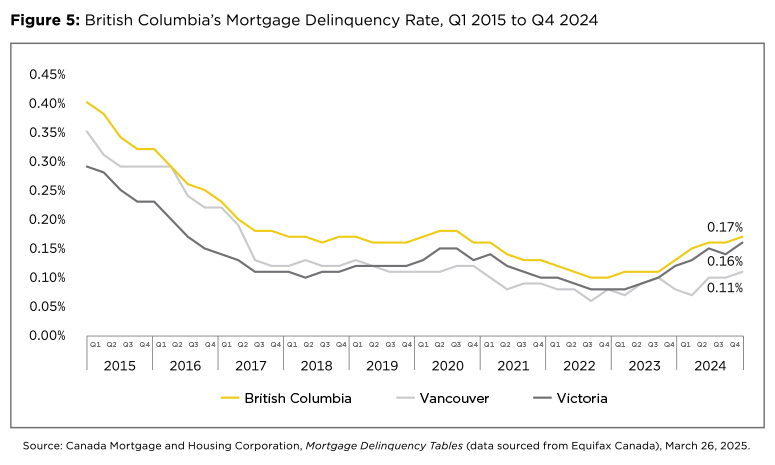

Due to high home costs, British Columbians are routinely among the most indebted of all Canadian residents. In fact, household debt in BC accounted for 188.2% of household disposable income in Q4 2024, second only to Ontario’s rate of 198.5%. This level of debt can put increased financial pressures on households during economic downturns.

Despite the high debt burden and recent uptick, BC’s mortgage delinquency rate remained near pre-pandemic levels. As of Q4 2024, 0.17% of BC mortgages were 90+ days in arrears, up from 0.13% one year earlier but in line with the 0.16% rate in Q4 2019 (see Figure 5). The trade war with the United States increases the likelihood of this metric increasing further, but the real impact will depend on the nature and duration of any trade action.

One reason for the low mortgage delinquency rate is the fact that younger people, who on average have less wealth and are more susceptible to economic shocks, are decreasing their debt burden by delaying home ownership. Higher real estate prices and interest rates have proven to be significant barriers to home ownership for many British Columbians.

The bottom line

With affordable housing still out of reach, more and more British Columbians are considering finding other places to call home. We need to increase the housing supply and remove barriers to home ownership if we want to not only keep but also attract more residents in the coming years.

Work also needs to be done to improve labour productivity and increase real incomes for more residents. Policies that aim to boost investment and make BC an attractive destination for capital will be essential going forward, especially as global trade flows are redefined.

Jack Blackwell is CPABC’s economist.

This article was originally published in the July/August 2025 issue of CPABC in Focus.

Footnotes

1 Brendon Ogmundson, “What Comes After Uncertainty? The Next Phase in BC’s Housing Market,” Market Intelligence, bcrea.bc.ca, May 15, 2025.

2 RBC Economics & Thought Leadership, “Focus on Canadian Housing,” rbc.com, May 7, 2025.

3 Includes new landed immigrants and net non-permanent residents.

4 Government of Canada, Immigration Levels Plan for 2025-2027, October 24, 2024.

5 Jack Blackwell, “BC’s Tipping Point,” CPABC in Focus, July/August 2024 (12-18).