CPABC recently launched its BC Check-Up: Live report, the second in its triannual series on investing, living, and working in British Columbia. This latest iteration focuses on BC’s strong population growth and ongoing housing supply and affordability challenges.

BC’s population growth rate surged

As of July 1, 2022, BC’s total population count was 5.32 million, representing a 16.5% increase from July 1, 2012—the equivalent of more than 750,000 new British Columbians. By comparison, BC’s average annual population growth between 2012 and 2019 was approximately 74,000, and between 2020 and 2021—during the height of the COVID-19 pandemic—it slowed to an annual average of approximately 53,800.

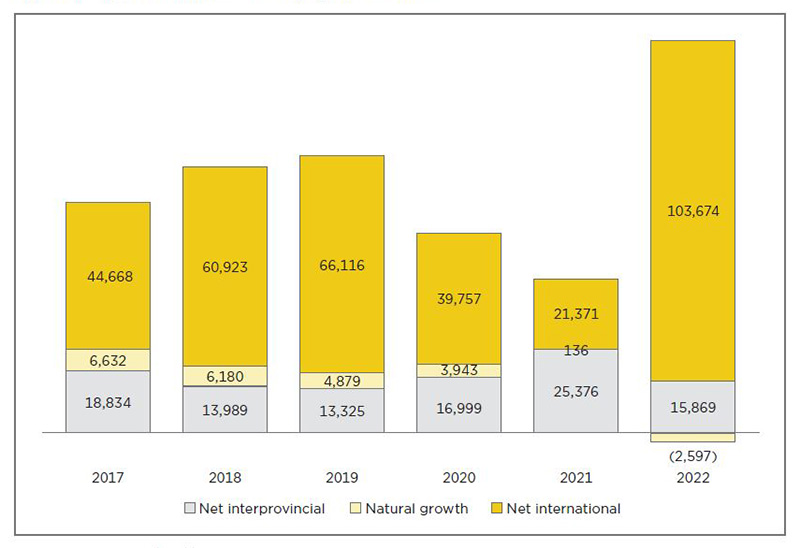

The slump experienced during the COVID-19 pandemic was largely due to the restrictions placed on international migration. Not surprisingly, as international migration resumed, BC started to see a corresponding recovery in its population growth.1 In fact, the province’s population added 116,949 new residents between July 1, 2021, and July 1, 2022 (a record high) and international migration accounted for almost 89% of this surge (see Figure 1). The 103,674 new residents from other countries was a number well above the average annual net inflow of 46,500 international migrants between 2017 and 2021.

The growth in international immigration is not just due to the lifting of travel restrictions; it’s also due to the federal government’s objective of welcoming a growing number of international immigrants. As noted in the November/December 2022 issue of this magazine, the government set a target of accepting 1.33 million new residents from other countries between 2022 and 2024.2 Toward that end, Canada welcomed a record number of 405,000 international immigrants in 2022, and it’s likely that this number will soon be surpassed. In fact, the federal government’s new immigration plan aims to accept 1.45 million international immigrants between 2023 and 2025, with target goals of 465,000 new residents in 2023 and 500,000 in 2025.3 Because BC is a primary destination for many new Canadians, the province’s population growth rate is expected to continue accelerating over the coming years.

Of course, BC is also a primary destination for residents from other Canadian provinces, and in 2022, interprovincial migration accounted for a net gain of 15,869 new residents.

Figure 1: Population Growth in BC by Type, 2017-2022

Source: Statistics Canada, Table 17-10-0140-01.

International migration offset lows in natural growth

The surge in BC’s population growth rate in 2022 is considered key to our economic recovery, as the provincial government—like its federal counterpart—sees international immigration as a way to offset the impacts of an aging population.4

It’s important to note that natural growth (births minus mortalities) was negative in 2022—the first time in BC’s history—as a result of BC’s aging demographics and declining fertility rates. Between 2012 and 2022, the average age in BC increased from 41.0 to 42.8; the percentage of BC residents aged 65 or older increased from 15.7% to 19.9% (nearing one in five); and the percentage of British Columbians aged 24 or younger dropped by 2.6 percentage points to 25.3%.

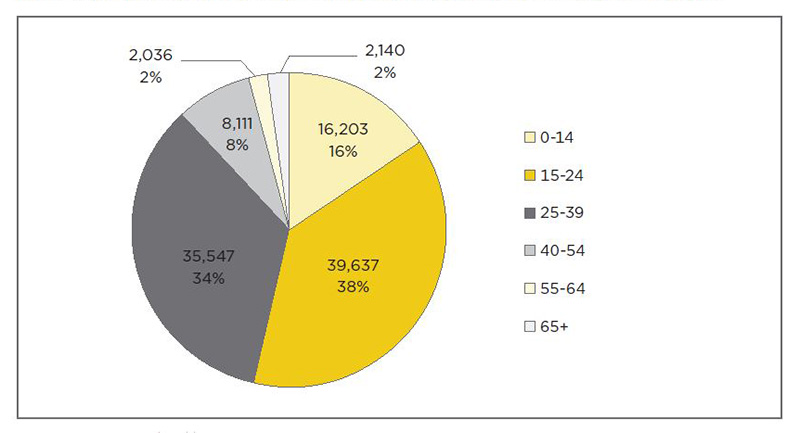

By contrast, a significant majority of the international immigrants who arrived in BC last year were younger than the provincial average. In fact, of the 103,674 new British Columbians who arrived from other countries in 2022, approximately 88% were 39 or younger, and 53.9% were 24 or younger (see Figure 2).

Figure 2: Net International Migration in BC by Age Category, Number, and % of Total, 2022

Source: Statistics Canada, Table 17-10-0140-01.

Considering the province’s aging demographics, new and younger British Columbians are needed not only to fill existing job vacancies but also to fill new vacancies that materialize as older residents reach retirement age. This influx will also help to support our aging population and increase the province’s diversity.

Housing completion slowed

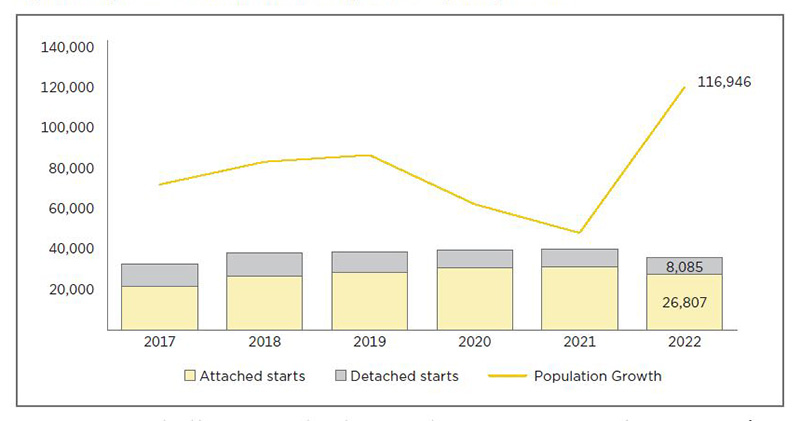

With population growth comes an increase in housing demand, but BC’s housing supply did not keep pace in 2022—in fact, the number of completed housing units declined. Compared to the 39,163 housing units completed in 2021, only 34,892 housing units were completed last year (see Figure 3). This meant that there were only 0.30 new completed housing units per new resident in 2022, the second-lowest ratio in BC since 1996 (0.23).

Additionally, many of the housing units constructed in recent years have been smaller ones, like condos and townhouses, which house fewer residents per unit. In 2022, for example, approximately 77% of the units constructed were attached units—up from 67% in 2017.

Figure 3: Population Growth versus Housing Units Completed, 2017-2022

Sources: Statistics Canada, Table 17-10-0140-01 and Canada Mortgage and Housing Corporation, Housing Market Data. Note: Data refers only to housing units completed in municipalities with populations of 10,000 or more.

Home ownership remained unaffordable for many

While housing prices weakened slightly over the past year, the gap between demand and supply growth continued to limit housing affordability in the province. A 2022 study conducted by the Canada Mortgage and Housing Corporation found that without a sustained increase in housing supply in BC, housing will remain unaffordable for many residents.5

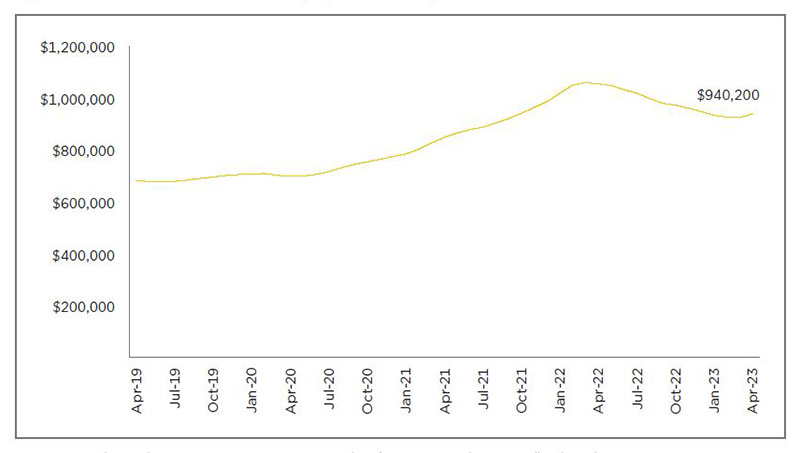

Compounding these challenges, the inflation rate reached a 40-year high in 2022, which prompted the Bank of Canada to dramatically increase its key interest rate (between March 2022 and May 2023, the rate increased from 0.25% to 4.5%).6 Over the past year, this weakened homebuyers’ purchasing power and reduced demand, causing housing prices to fall (see Figure 4). As a result, the benchmark housing price in BC in April 2023 was $940,200, down 10.9% from April 2022.

However, this April 2023 benchmark housing price was still 37.6% higher than the price in April 2019, indicating that the recent drop has done little to offset the dramatic price hikes seen in 2020 and 2021.

Figure 4: BC House Benchmark Price, April 2019 to April 2023

Source: Canadian Real Estate Association, Composite Benchmark Home Price Index. Seasonally adjusted.

Consider Vancouver Island, for example (see Table 1). Although the region saw the second-largest decrease in housing prices between April 2022 and April 2023 (-12.1%), it saw the second-largest increase between April 2019 and April 2023 (+43.8%). All of BC’s largest regions saw similar results, with prices declining over the past year but staying well above 2019 levels. (Notably, despite the fact that its housing prices grew at a slower rate than those in other regions over the past three years, the Lower Mainland still had the highest prices—and by a considerable margin.)

Table 1: BC House Benchmark Price by Region, April 2023

|

Vancouver Island |

Lower Mainland |

Victoria |

Interior BC |

Fraser Valley |

|

|

Benchmark price, April 2023 |

$663,000 |

$1,077,300 |

$855,400 |

$660,500 |

$962,600 |

|

% change since April 2022 |

-12.1% |

-10.8% |

-10.5% |

-9.4% |

-16.9% |

|

% change since April 2019 |

43.8% |

29.6% |

32.7% |

44.9% |

40.4% |

Source: Canadian Real Estate Association, Composite Benchmark Home Price Index. Seasonally adjusted.

The downturn in housing prices is not expected to continue. Housing prices across the country have already started to rebound as a result of both renewed demand and a 20-year low in the housing supply available on the market in April 2023.7 And despite the high interest rate environment, experts predict that we may already have reached the low point for housing prices. For instance, RBC Economics recently suggested that the bottom of the housing downturn in Canada likely occurred in the spring of 2023.8

Rental rates continued to soar

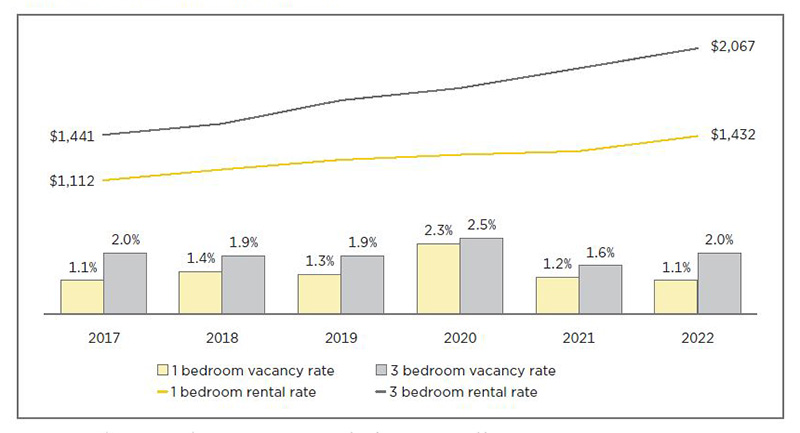

The low availability and high cost of rental units across the province also demonstrated the extent of the housing affordability challenge for British Columbians in 2022. Even though the province capped rent increases at 1.5% for existing tenants in 2022, affordability continued to erode. The average rent for units with three bedrooms or more was $2,067 a month in 2022, up 7.5% from 2021, while the average rent for one-bedroom units was $1,432, up 8.3% (see Figure 5). Compared to 2017, the average monthly rental rate for units with three or more bedrooms was $626 higher in 2022; for one-bedroom units, the increase over this same period was $320.

Figure 5: BC Rental and Vacancy Rates, 2017-2022

Source: Canada Mortgage and Housing Corporation, Rental Market Survey Data Tables.

Compounding BC’s affordability challenge is the fact that housing price escalation has eclipsed income growth. As of 2021 (the latest data available), the median after-tax income for families in BC was $97,800, a gain of 0.4% from 2020; for single individuals, the median after-tax income in 2021 was $39,200, an increase of 3.4% from the previous year. Overall, the median after-tax income in BC grew by 5.2% between 2017 and 2021, considerably lower than the corresponding growth in the average benchmark prices for housing (16.3%) and rentals (19.9%).9

Top policy priorities

As described, several factors are converging to create an untenable living situation for many who want to live in British Columbia. If left unchecked, soaring housing prices will discourage immigrants from choosing BC as their destination of choice. These same prices will also displace current residents, particularly if income growth fails to keep pace.

Therefore, a multi-faceted approach is needed to effectively tackle the housing crisis and ensure the province’s ongoing attractiveness to international immigrants, Canadians in other provinces, and existing residents. Policies that improve the region’s productivity and long-term economic outlook, with a primary goal of boosting the income of British Columbians, must be prioritized.

CPABC Survey Highlights Need To Tackle Housing Affordability

According to the results of CPABC’s 2023 BC Check-Up: Live survey,* a majority of CPAs expect housing affordability in BC to worsen over the coming year. Despite the high interest rate environment and the recent weakening of housing prices in BC, 53% of survey respondents said they expect housing affordability to be worse in 2023 than in 2022. Only 10% said they expect housing affordability to improve, while the balance (36%) said they expect it to stay the same.

These high housing prices are perceived as a significant challenge for businesses, impeding their ability to attract and retain talent. Respondents ranked high housing prices as the second-biggest barrier to business success after the labour shortage. Notably, high housing prices have been identified as a major challenge for businesses in BC since the BC Check-Up survey series first posed the question in 2019.

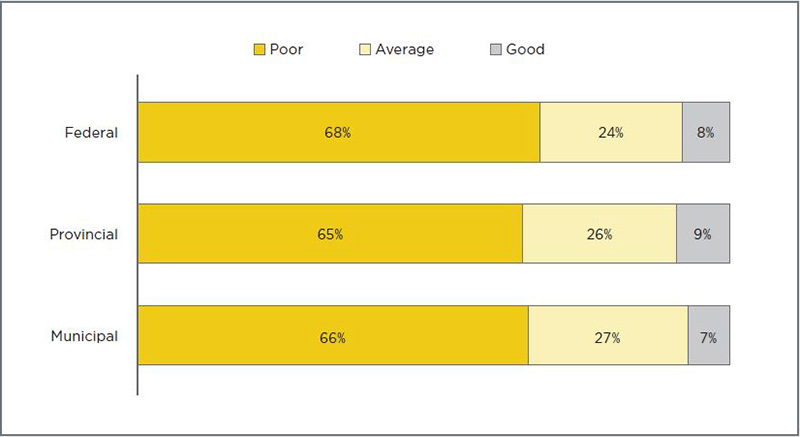

The majority of respondents also said that all levels of government could be doing more to address affordability issues in the province (see below). These survey results underscore the need to prioritize efforts to attract more workers to the province while at the same time making housing more affordable.

Rating on Government Performance on Improving Affordability in British Columbia

Source: CPABC BC Check-Up survey, n = 714. Conducted from March 31 to April 28, 2023.

* CPABC commissioned Leger to conduct a web-based survey of CPA members across BC to solicit their thoughts on the province’s current and future economic situation and on their current workplace environment. A total of 714 surveys were completed between March 31 and April 28, 2023, which represents an overall response rate of 11%. Survey results may not sum to 100% due to rounding.

At the time of this writing, Aaron Aerts was the economist for CPABC. He has since moved on to pursue new opportunities, and we wish him well!

This article was originally published in the July/August 2023 issue of CPABC in Focus

Footnotes

1 To read more about the population slowdown during the COVID-19 pandemic, see “The High Cost of Living in British Columbia” in the July/August 2022 issue of CPABC in Focus (14-24).

2 Aaron Aerts, “Work in BC,” CPABC in Focus, November/December 2022 (22).

3 Geoff Nixon, “Canada’s Plan for More Immigrants Aims to Boost Workforce, but Experts Say They’ll Need Support,” CBC News, November 6, 2022.

4 Government of Canada, “An Immigration Plan to Grow the Economy,” news release, November 1, 2022.

5 Canada Mortgage and Housing Corporation, Canada’s Housing Supply Shortages: Estimating What Is Needed to Solve Canada’s Housing Affordability Crisis by 2030, June 2022.

6 To read more about BC’s inflation and interest rates, see “Investing in BC,” CPABC in Focus, March/April 2023 (14-22).

7 Rachelle Younglai, “Canadian Housing Market Rebounds in April with Supply at 20-year low,” The Globe and Mail, May 15, 2023.

8 Robert Hogue, “Canada’s Housing Markets Heat up This Spring,” RBC Economics, May 5, 2023.

9 Housing data: Canadian Real Estate Association, Composite Benchmark Home Price Index (seasonally adjusted). Rental data: Canada Mortgage and Housing Corporation, Rental Market Survey Data Tables.