On May 17, 2021, the Business Council of British Columbia (BCBC) launched a five-part series on environmental, social, and governance (ESG) principles called “ESG in B.C.: An Opportunity for a Sustainable Economy.” Slated to run through mid-October, the series consists of five virtual sessions focused on different aspects of ESG in BC, complemented with written commentary and digital content. CPABC is a proud sponsor of this series.

The second virtual session, “Embedding Sustainability through Governance,” took place on June 17. The event focused on strategies and tools for businesses looking to establish and meet goals related to sustainability—including equity, diversity, and inclusion—and I was pleased to provide opening remarks and lead the first panel discussion. In my opening remarks, I described how members of the accounting profession have been deeply involved in driving both the adoption of ESG principles and the evolution of ESG reporting in BC and beyond.

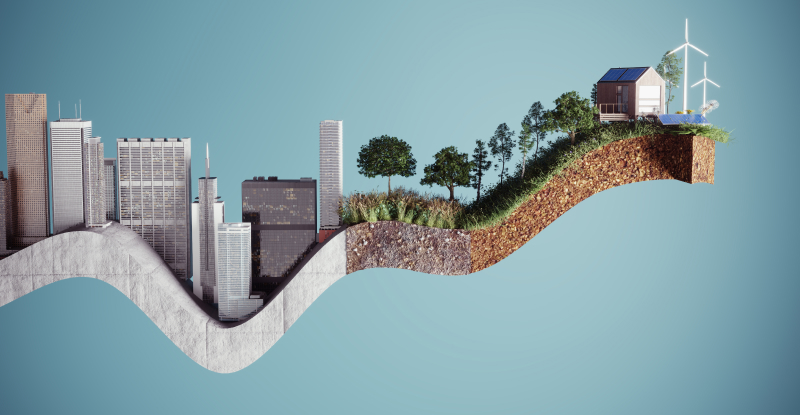

It’s clear that we need to normalize and integrate ESG into how we do business in general. Consider the words of the Expert Panel on Sustainable Finance, which was appointed by the federal government in April 2018 to “scale and align sustainable finance with our country’s climate and economic goals.” In its final report, the panel says: “If Canada is to meet its long-term objectives, sustainable finance must become, simply, finance. In other words, climate change opportunity and risk management need to become business-as-usual in financial services, and embedded in everyday business decisions, products and services.”

This desire to “bring sustainable finance into the mainstream” has only intensified over the last three years, as investors have demanded that more attention be paid to climate issues and to ESG matters more broadly. Unfortunately, Canada is lagging globally (particularly vis-à-vis the European Union) when it comes to both investing in ESG and factoring climate change and social issues into risk mitigation strategies. Canada needs to do more—we need to intentionally build ESG into more holistic strategies, and we need to create appropriate reporting to demonstrate transparency and accountability.

At a micro level, this means that corporations must identify why they should integrate ESG into their strategic and operational plans. This “why” is what will create the buy-in needed to drive action and change, and the answer could be as simple as “compliance requirements.” However, because ESG strategy and reporting is often completely voluntary, we need to look at other possible reasons to embrace ESG.

Chief among them is access to capital, which was an important focus at the first BCBC session in May. A recent RBC survey found that 75% of institutional investors incorporated ESG principles into their investment process in 2020, up from 70% the year before. And it’s not just equity—230 banks (including some in Canada) have signed the United Nations’ Principles for Responsible Banking, a “unique framework for ensuring that signatory banks’ strategy and practice align with the vision society has set out for its future in the Sustainable Development Goals and the Paris Climate Agreement.” This will have significant consequences for those seeking commercial financing, as the participating banks represent more than a third of the global banking industry.

An ESG strategy could also be developed for risk-mapping purposes to manage the broadest range of risks, including transitional risks and economic shifts. In addition, a sincere focus on ESG could be used to attract new customers and partners, and significantly influence an organization’s reputation. And we can’t forget talent attraction and retention, as we are seeing a generational shift in terms of ESG, with many younger workers expecting employers to take action on sustainability and demonstrate accountability.

ESG can itself be an opportunity to innovate and enter new markets, and we are fortunate to have so many companies here in BC taking advantage of this opportunity. We’re also seeing some small and mid-sized organizations getting pulled into ESG because of the procurement expectations of larger corporate leaders who are driving ESG change through the supply chain.

Bottom line: It’s not enough to just take on ESG initiatives. In addition to ensuring that there is a strong link to risk management and corporate strategy, businesses must provide relevant ESG disclosures to give stakeholders the full story. Everyone knows that what gets measured, gets managed.

One of the current challenges is that there are no internationally recognized ESG reporting standards. And in the absence of a comparable and consistent set of standards, corporations around the world have adopted an alphabet soup of voluntary frameworks and guidelines, including those from the Global Reporting Initiative, the Sustainability Accounting Standards Board, and the Task Force on Climate-related Financial Disclosures.

Companies, investors, and accounting standard-setters all agree that ESG reporting frameworks need to be harmonized into a common set of standards. Indeed, in November 2020, CEOs from Canada’s eight leading pension plan investment managers—representing approximately $1.6 trillion in assets under management—called on companies and investors to provide consistent and complete ESG information.

Various standardization projects are underway that would see a convergence of disclosure standards. For example, the IFRS Foundation is now spearheading a co-ordinated effort to create a global set of internationally recognized sustainability reporting standards. It is anticipated that the creation of a new International Sustainability Standards Board will be announced at the COP26 UN Climate Change Conference this fall.

As the world grapples with climate change, an increasing focus on social inequities, and the need to ensure sustainability, every company must develop its own unique ESG strategy, with a customized approach to governance, measurement, and transparency—all of which are fundamental to the successful implementation of ESG principles and practices. Companies must then embed ESG practices into their operations and report on their progress. Ultimately, success will depend on how well each organization articulates a clear and compelling case for change and genuinely embraces the need to transform.

Lori Mathison, FCPA, FCGA, LLB, is the president & CEO of CPABC.

Recordings of the ESG sessions can be found on the BCBC’s YouTube channel.

Originally published in the September/October 2021 issue of CPABC in Focus.